Infrastructure Marketwatch: New transport, water opportunities

Governments continue to invest in various infrastructure projects. In this blog, we provide a small sample of recent initiatives, trends and opportunities for Canadian companies in the transport and water infrastructure arena.

G7 commitment to infrastructure investment

At the June 2022 G7 meeting at Schloss Elmau, Canada, France, Germany, Italy, Japan, the United Kingdom and the United States pledged to raise $600 billion in private and public funds over five years to finance needed infrastructure in developing countries

Targeted as an alternative to China’s Belt and Road project, the United States said it would mobilize USD $200 billion in grants, federal funds and private investment over five years for the Partnership for Global Infrastructure and Investment (PGII). Europe plans to mobilize another 300 billion euros (USD $317.28 billion) towards the initiative. President Biden also stated that hundreds of billions of additional dollars could come from multilateral development banks, development finance institutions, sovereign wealth funds and others. The funds are designed for projects in low- and middle-income countries that help tackle climate change and improve global health, gender equity and digital infrastructure.

Related: G7 Leaders Statement Partnership for Infrastructure and Investment

Related: G7 Leaders’ Communiqué

This initiative is yet another example of how there continues to be many opportunities for investors and companies in infrastructure, especially those focused on technology-enabled infrastructure. In this blog, we provide a small sample of recent initiatives, trends and opportunities in the transport and water infrastructure arena.

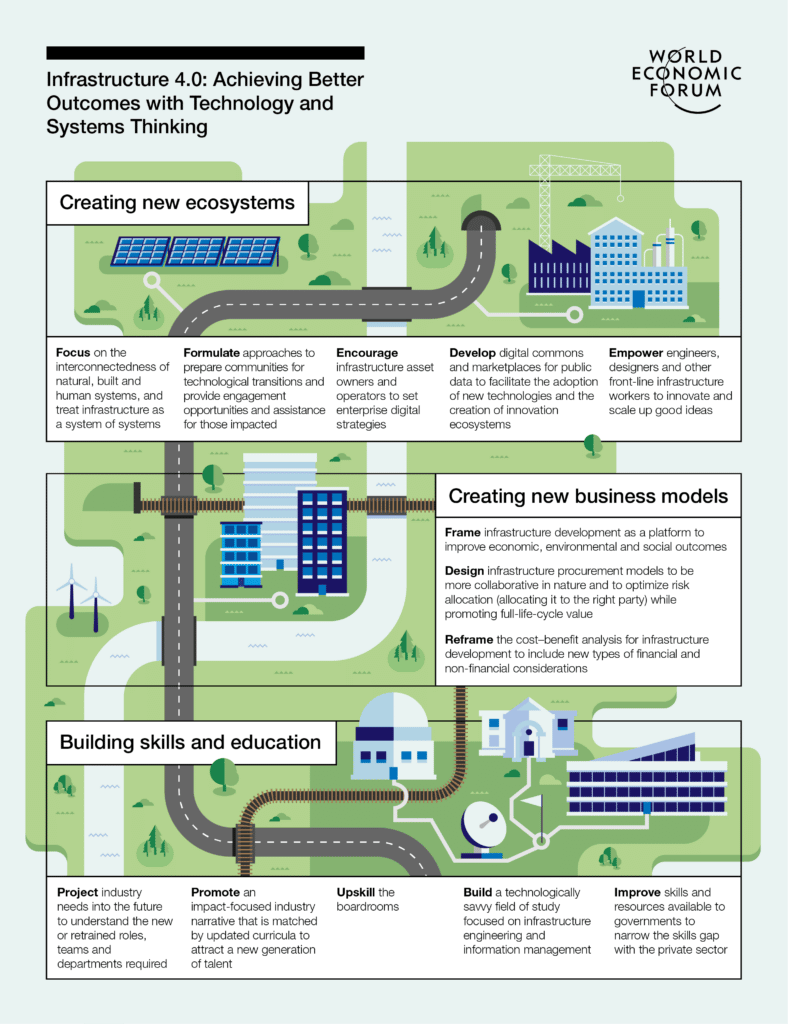

WEF Infrastructure 4.0 – infrastructure + technology

According to the World Economic Forum, infrastructure is one of the least technologically transformed sectors in the entire economy and there is a push towards incorporating more technology in infrastructure projects. By changing the way governments and organizations plan, design, finance, build and operate their infrastructure systems, it is expected that more countries will be able to achieve their goals around sustainability, social cohesion and inclusive economic growth.

The role of technology in infrastructure is the reason that the World Economic Forum Infrastructure 4.0 project community was formed. Designed to work across sectors and industries, the initiative is focused on providing a framework on how to integrate digital technologies with physical assets.

The thirteen recommendations of the group are categorized into three main thematic areas:

- Creating new ecosystems, is about providing an environment within government and private industry to foster greater collaboration and alignment.

- Creating new business models, aims to shift the existing decision-making paradigm to include other factors, including non-monetary factors, in business decisions.

- Building skills and education, provides guidance on how to evolve the skills, training, and education in people in order to adapt to a rapidly changing world.

Source: World Economic Forum

The project community consists of a global group of experts and stakeholders from 17 countries. Community members include representatives from the private sector in multiple industries, national and subnational governments, multilateral institutions, and academia. Canadian members of the group include:

- Co-Chair: Sara Alvarado Executive Director, Institute for Sustainable Finance (ISF), Smith School of Business, Queen’s University, Canada

- Member: Colin Earp Leader, National Transport; Global Infrastructure Technology Chair, KPMG, Canada

- Member: Annie Ropar Chief Financial Officer and Chief Accounting Officer, Canada Infrastructure Bank, Canada

This white paper provides more details about each of the recommendations but one of the key messages of the initiative is that there will be many opportunities in the “physical-digital infrastructure”, which includes broadband, self-driving cars, and “smart infrastructure” solutions.

Companies that leverage technologies like AI/machine learning, cloud computing, cybersecurity technologies, autonomous/electric vehicles and 5G in infrastructure solutions will be viewed with interest.

Transport infrastructure opportunities in EU

The European Union continues to grow its investment in infrastructure projects. In June 2022, the European Commission selected 135 transport infrastructure projects for EU grants. These were selected from proposals submitted under the Connecting Europe Facility (CEF), the EU’s funding instrument for strategic investment in transport infrastructure.

"Today we are allocating €5.4 billion to projects across Europe that will improve missing infrastructure links, make transport more sustainable and efficient, increase safety and interoperability, as well as create jobs."

Adina Vălean, Commissioner for Transport, EU

With the announcement of the projects, the next step is for the European Climate, Infrastructure and Environment Executive Agency (CINEA) to start the preparation of the grant agreements with the beneficiaries of the 135 selected projects.

Projects will include rail infrastructure projects on the Trans-European Transport Network (TEN-T), upgrading existing rail-road trans-shipment terminal in Slovakia, basic port infrastructure upgrades and the installation of on-shore power supply, inland waterway transport projects to connect France and Belgium, Intelligent Transport Systems to improve road safety and create secure and safe parking infrastructure for heavy goods vehicles in Spain, Romania, France, Hungary and Italy, and continued digitization of the European Rail Traffic Management System.

Many of the projects selected for the grants have an automation or digitization component which aligns with the trend towards including more technology in infrastructure.

Every year we help Canadian companies win millions in contracts with foreign governments. Download our guide to learn more about our approach, how we prepare you, and priority sectors.

Capturing opportunities in the EU

This investment may create new business opportunities for Canadian companies who currently do business or are looking to do business in the EU. Canada and the EU have a free trade agreement, Canada-EU Comprehensive Economic and Trade Agreement (CETA), which reduces tariffs on Canadian goods, provides preferential tariff treatment for some Canadian goods, reduces regulatory requirements that are unnecessary or discriminatory and provides level-access to government procurement opportunities.

For Canadian infrastructure companies, EU tariffs are eliminated on all originating products used in building and maintaining infrastructure such as, construction materials, power generating machinery, electrical equipment, rail products, infrastructure related ICT products and more. There are some sectors that are excluded from CETA including ports and airports, shipbuilding and maintenance but given the breadth of the projects announced, there may be more opportunities than exclusions.

The EU publishes contract notices on is Tenders Electronic Daily (TED). These are pulled in daily to Canada’s Global Bid Opportunity Finder (GBOF) and auto-translated into English and French for Canadians – regardless of the language they were posted in. Canadians can use GBOF for free. Register now to start viewing opportunities posted on TED and other online portals.

Water infrastructure opportunities in EU

The EU is also investing in clean water. The Commission recently approved an investment of more than €127 million from the Cohesion Fund to solve water supply problems by developing the water and wastewater infrastructure in Buzău county, Romania.

Past water projects through the Cohesion Fund include upgrading the Domžale-Kamnik central wastewater treatment plant in Slovenia’s Zahodna region and upgrading of the water-supply infrastructure serving 41 settlements in the communities of Meliti, Perasma and Kato Kleines in the Florina municipality in the West Macedonia region.

Water infrastructure opportunities in Africa

In Africa, there are many opportunities to support water supply and sanitation projects. The African Development Bank Group, offers many loans and grants for water infrastructure upgrades and some recently announced projects include:

- Zimbabwe: ZimFund brings relief to Dangamvura residents after 22 years of dry taps

- Tanzania: $125.2 million loan agreement signed to address water shortages in Dodoma region

- Kenya: Sewerage plant changing the face of Kenya’s Narok town

- Burkina Faso, Mali, Niger and Somalia: Denmark extends $30 million grant to African Water Facility for climate-smart water and sanitation services in four drought-prone countries

- South Africa and Lesotho: African Development Bank approves $86.72 million loan to boost water security and socio-economic development

Visit the project-related procurement documents section to find more information about procurement plans for projects of interest.

Water infrastructure opportunities in Latin America

Like in Asia and Africa, there are many funds that support water projects in Latin America. The Inter-American Development Bank also provides financing for water and sanitation projects and currently has 71 active projects in this sector. The bank provides a list of awarded contracts by project and country. Canadian businesses looking to participate in these projects can also look at the procurement notices.

Water infrastructure opportunities in Asia

When we look at other regions, in Asia, it is estimated that 2 billion people lack adequate water and sanitation. The Asian Development Bank has a number of water projects that are active and approved. Recently approved projects include:

- India: Integrated Urban Flood Management for the Chennai-Kosasthalaiyar Basin Project Project

- Kyrgyz Republic: Readiness for the Issyk-Kul Environmental Management and Sustainable Tourism Development

- China: Asia Cube Wastewater Treatment Upgrade Project

- Bhutan: Phuentsholing Township Development Project

- Viet Nam: Binh Duong Water Treatment Expansion Project

Visit the ADB for recently approved projects and tender opportunities in Asia.

Southeast Asia highest growth potential market for infrastructure

There are many more infrastructure initiatives in the Southeast Asian region besides opportunities in the water sector. There is a plan to spend $600 million on a global submarine telecommunications cable connecting countries between Singapore and France, including Bangladesh, Djibouti, Egypt, India, the Maldives and Pakistan, with reliable, high-speed internet.

Below are a few examples of what is happening at the country level:

Philippines

The Philippines is resetting its approach to infrastructure projects. The Philippine Department of Transportation (DOTr) recently announced that it has effectively canceled three major railway projects with Chinese counterparts initiated under the previous administration due to withdrawal of funding. However, President Ferdinand “Bongbong” Marcos Jr wants more investments in the rail transport sector as he directed the DOTr to go back to the negotiating table to secure the loan agreements.

President Marcos also promised to continue the infrastructure developments made under his predecessor, former President Rodrigo Duterte. A resolution was filed that proposes the “Build, Build More” program as a national infrastructure development framework, which shall prioritize the completion of infrastructure projects that have been implemented or have been prepared for implementation by the Duterte administration and other previous administrations.

CANBuild G2G Philippines is a new program launched jointly by the Canadian Commercial Corporation (CCC), Export Development Canada (EDC) and the Trade Commissioner Service to partner with Canadian businesses win infrastructure contracts with the Philippine government. To discuss this initiative, contact us.

Indonesia

In Indonesia, the Public Works and Public Housing (PUPR) Ministry is offering 26 infrastructure projects throughout to 2023 with a value of Rp165.68 trillion (USD$11 billion) to investors using the public-private partnership (PPP) scheme.

Bangladesh

Bangladesh is expected to require an investment of about 35 billion USD by 2041 in the power sector. The World Bank also approved $500 million credit to help the country improve disaster preparedness against inland flooding in 14 flood-prone districts, benefiting over 1.25 million people.

The Asian Development Bank (ADB) also has a number of initiatives in Bangladesh. According to its fact sheet, the first tranche ($400 million) of a corridor road project will help construct the 210-kilometer Dhaka–Sylhet highway. An additional $13.5 million loan will scale up an ongoing project to modernize irrigation and improve the management, operation, and maintenance of large irrigation schemes. ADB also provided $9.6 million in grants and technical assistance for reforming social protection, and public financial management systems, capacity building for cottage, micro, and small-sized enterprises (CMSEs), managing water resources and road safety and maintenance, and strategic transport planning.

Participating in infrastructure opportunities for Canadian business

The above is just a small sample of opportunities in the water infrastructure sector. Canadian businesses that would like to know more about these and other international projects, and whether there is an opportunity for them should consult with the Canadian Trade Commissioner Service.

Another option is to use Canada’s Global Bid Opportunity Finder (GBOF) to look for procurement notices. The tool receives 5,000 new bid requests every day and is available for free to Canadian businesses upon registration.

Demand for PPP for infrastructure projects growing

Aside from approved projects, Canadian businesses also have the option to leverage public-private partnerships (PPP) to build direct business relationships with governments and create infrastructure opportunities.

“COVID has been the number-one priority for every government to deal with. Healthcare has placed a great deal of financial strain on governments, and yet infrastructure needs are always there. So, we’re seeing countries that have never done public–private partnerships (PPPs) now doing 10 to 15 a year.”

Christian Dechamplain, Account Director, CCC

For Canadian companies to be competitive in this new environment, they need to bring equity and financing to the table. Governments expect both a technical and financial solution to projects,” says Dechamplain. “Make sure you identify your funding sources in the proposal to show that your bid is viable, appealing and bankable.”

Beyond partners with project cash, governments also want to do business with companies that are ready to provide community benefits, whether by sharing IP, manufacturing locally or employing local workers.

“It’s no longer about bringing in your own workers, equipment, materials,” Dechamplain says. “Hire local partners, help grow the tax base and raise incomes on the ground.” Even if this is not a technical requirement of a specific bid, including localization can boost the chance of success.

Companies with sufficient means can also take the burden off governments by investing in pre-feasibility studies and market research before putting together proposals. “Governments aren’t able to fund this sort of foundational work anymore, and they may be impressed that you’ve taken the initiative,” Dechamplain explains.

How Canada and CCC can help

The Canadian Commercial Corporation offers several services to help Canadian businesses pursue government infrastructure project opportunities. In addition to export advice, including how to participate in PPPs, we offer a program called International Prime Contractor program. In this program, we use teaming arrangements, take the role of prime contractor, and provide a Government of Canada guarantee of contract performance for the government buyer. The result is we help to facilitate faster procurements, reduce procurement risk, and improve project outcomes for foreign government buyers.

Another option is to use Canada’s Global Bid Opportunity Finder (GBOF) to look for procurement notices. The tool receives 5,000 new bid requests every day and is available for free to Canadian businesses upon registration.

This post was last updated on August 17, 2022.

In this blog you’ll learn how the close collaboration of CCC, Trade Commissioner Service, and Export Development Canada (EDC), helped the Canadian company Groupe Helios to secure a USD $50 million-dollar contract with the Dominican Republic. The G2G contract will clean a segment of the Guajimia ravine and improve the lives of 350 000 people.

Terragon Environmental Technologies is a small Canadian company with a big vision: to make everything from remote military bases to resorts and cruise ships as environmentally self-sustainable as possible. With innovative waste and water management solutions designed to make that vision come true, Terragon has caught the attention of big-league buyers around the world — including the U.S. Department of Defense (DoD).

Let us help you explore ways that the Government of Canada can help you win more international deals.