eBook: Cleantech market opportunities for Canadian businesses

Whether your products and services involve smart grids, smart city technologies, water treatment, waste management or other environmental solutions, foreign governments are looking for clean technology (cleantech) solutions to meet their renewable energy, water, and sustainability goals. Learn more about the massive global cleantech opportunity, and how Canadian companies can sell their products, solutions, and services to foreign governments.

With the increasing demand for clean technologies worldwide and Canada’s commitment to diversify global export trade across various industries and markets, Canadian cleantech businesses have abundant opportunities to take their solutions to the international stage.

According to a report by International Energy Agency, the global cleantech market is projected to exceed $1.7 trillion in 2023. This represents a massive opportunity for forward-thinking companies that realize that the path to growth is beyond Canada’s borders.

In this blog, we will provide some market information across various cleantech segments:

Global renewable energy market | Market potential: Solar | Market potential: Wind | Market potential: Geothermal | Market potential: Water and wastewater | Market potential: Recycling and recovery | Government of Canada support

Global renewable energy market

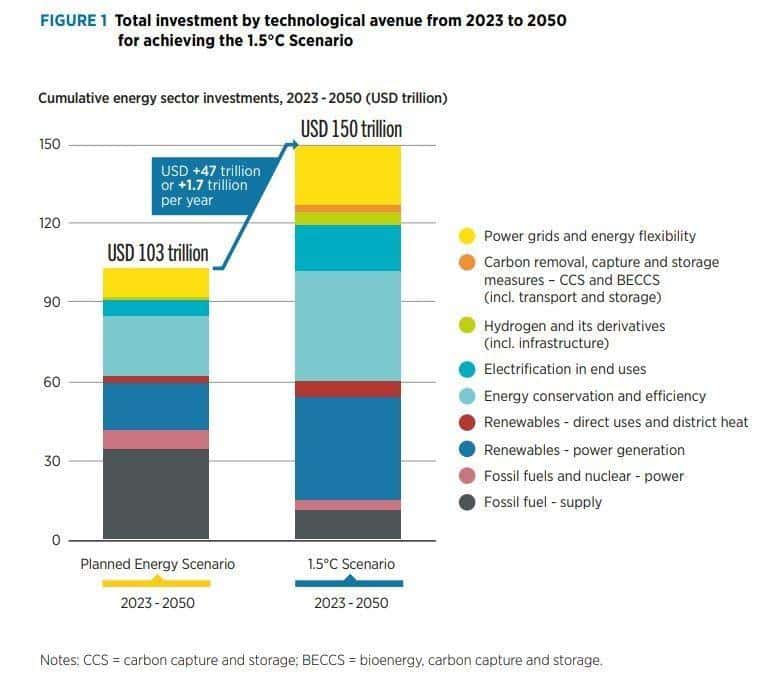

The global renewable energy market is expected to continue its upward growth and according to IRENA’s World Energy Transition Outlook 2023, it needs to hit a cumulative $150 trillion USD (over $5 trillion USD in annual terms) to realise the 1.5°C global warming target by 2050.

Like Canada, governments around the world are coming to the same realization that, to reach a secure, sustainable, and economically viable energy system, their policies must encourage and support renewable energy sources. This means not only investing public funds in renewables, but also laying the foundation so that renewables can be seamlessly integrated into modern infrastructure. Embracing cleantech will be key to reducing global greenhouse gas emissions and satisfying global governments’ climate commitments through technology.

Total investment by technological avenue from 2023 to 2050 for achieving the 1.5°C scenario

SOURCE: The International Renewable Energy Agency (IRENA)

The amount of funding provided for clean energy worldwide has also steadily increased over the last two decades. In 2004, clean energy investments totalled just under $37 billion USD and according to the International Energy Agency, is set to hit $1.7 trillion USD in 2023.

There are many different sources of renewable energy available (solar, wind, biomass, and waste-to-energy, geothermal, marine) but investment in solar and wind energy is by far the highest. Global investment in solar energy has soared since 2004, rising from just over $10 billion USD to more than $308 billion USD in 2022, according to BloombergNEF.

See which are the top 10 countries by clean energy investment

Power Purchase Agreements – Tool for Canadian cleantech exporters

According to International Energy Agency’s June 2023 Renewable Energy Market Update, market-driven procurement of energy such as power purchase agreements (PPAs), is expected to account for one-fifth of utility solar photovoltaic and wind capacity expansion between 2023 and 2024, and almost twice as much (36 percent) when China is excluded. This represents a significant portion of the market.

Learn more about PPAs and how CCC supports Canadian businesses with PPAs.

Market potential: Solar

Over the past decade, the demand for solar photovoltaic (PV) power has skyrocketed worldwide. What started as a niche market has now become a major player in renewable electricity, thanks to decreasing generation costs and a push towards clean energy. Although solar power prices can vary across regions, it remains a dominant force in developed countries, while emerging economies face higher costs.

According to the IEA Photovoltaic Power Systems Programme, in 2021 China led the way in the installation (54.9 Gigawatts) and cumulative capacity (308.5 Gigawatts) for solar energy. The United States was second for annual installed capacity (26.9 Gigawatts) while the European Union was closely behind in third place at 26.8 Gigawatts. The EU currently leads the U.S. with cumulative capacity at 178.7 Gigawatts compared to 123 Gigawatts for the United States.

The IEA also found that in 2022 China continues to lead in terms of solar PV capacity additions, with 100 GW added in 2022, almost 60% more than in 2021. The European Union is accelerating solar PV deployment in response to the energy crisis, with 38 GW added in 2022 while and the Inflation Reduction Act in the United States is expected to provide a significant boost to PV capacity and supply chain expansion. India installed 18 GW of solar PV in 2022, and a new target to increase capacity and development of the domestic supply chain are expected to result in further growth.

See the top 10 countries by installed solar PV capacity worldwide

Market potential: Wind

Like solar PV, wind power generation has been soaring to new heights, driven by decreasing costs and the growing economic influence of Asia. Until recently, European countries dominated the market for cumulative wind power capacity installations, renowned for their onshore wind capabilities. However, a remarkable shift began in the mid-2000s when China emerged as the powerhouse behind the rapid surge of wind energy.

China overshadows other nations when it comes to new installed onshore wind capacity, accounting for 42% of all new installations globally in 2021. The country’s massive size and long coastline gives it a unique capacity to produce a large amount of wind power.

According to IEA, wind electricity generation increased by 14% to a record 265 Terawatt hour (TWh) in 2022, reaching more than 2,100 TWh. This was the second highest growth among all renewable power technologies, behind solar PV.

Looking ahead, to get on track with the Net Zero Emissions by 2050 the IEA states that the average annual generation growth rate needs to increase to about 17%. Achieving this will require increasing annual capacity additions from about 75 GW in 2022 to 350 GW in 2030.

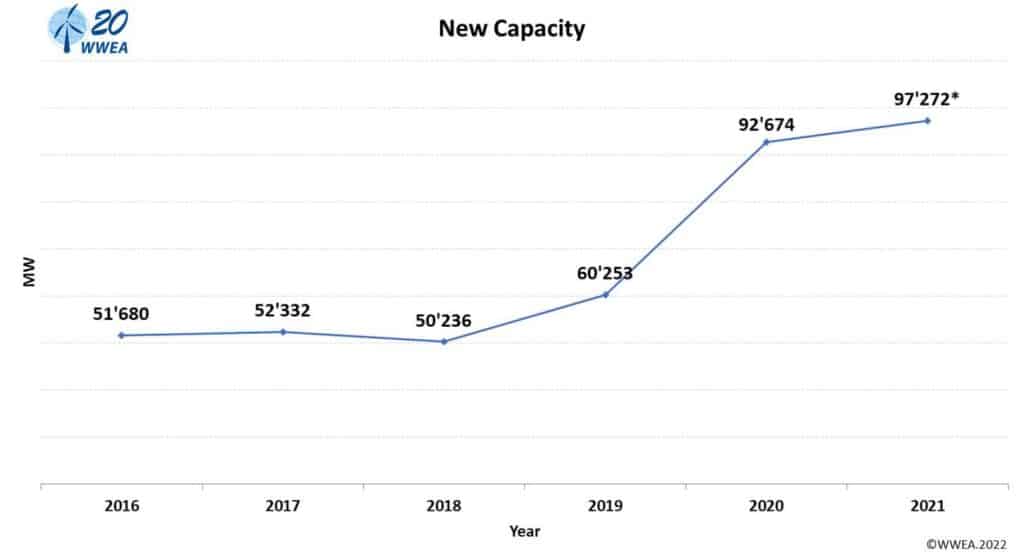

New wind power capacity from 2016 to 2021

SOURCE: World Wind Energy Association: World Market for Wind Power Saw Another Record Year in 2021: 97,3 Gigawatt of New Capacity Added

Market potential: Geothermal

While not as common as wind and solar, geothermal energy has been steadily gaining momentum in the past decade. In 2021, it reached an impressive 15.6 gigawatts. The market size for geothermal energy was $52.9 billion USD in 2020, and it’s projected to grow to $83.3 billion by 2028. Just like other forms of renewable energy, Asia is expected to lead the charge in geothermal energy expansion.

When it comes to geothermal power, the United States leads the market as the largest producer with 17 billion kilowatt-hours (kWh) in 2022. Indonesia and the Philippines not only have ambitious geothermal energy projects in the pipeline, they are also home to some of the world’s largest geothermal plants.

Market potential: Water and wastewater

From access to safe drinking water to its vital role in water-intensive agriculture, electricity, and manufacturing—the essential nature of water means that opportunity in this area is resilient to economic fluctuations.

In fact, estimated investment needs are projected to consistently rise to $6.4 trillion globally ($316 billion annually) by 2040. The surge in investment in sustainable water and wastewater infrastructure technology is being fueled by various factors, including government commitments to the sustainable development goals (SDGs) and the emergence of the “blue economy,” which advocates for the sustainable use of ocean resources.

Download the full guide to learn more about the massive global cleantech opportunity, and how Canadian companies can sell their products, solutions, and services to foreign governments through CCC.

Market potential: Recycling and recovery

As landfills edge closer to their limits, the urgency of sustainable waste management processes grows for cities and countries worldwide. The global waste management market was valued at 1.3 trillion U.S. dollars in 2022 and is predicted to reach $1.96 trillion USD by 2030—a CAGR of 5.4 percent (Statista).

The escalating potential in this sector is propelled by various factors, most notably the surge in environmental consciousness aiming to combat pollution, illegal dumping, and other perils that threaten our delicate global ecosystems.

Governments are investing more in Sustainable Materials Management (SMM) to reduce both the environmental impacts and costs associated with sourcing expensive virgin materials. There is also a push towards conversion technologies that move away from harmful combustion and opt towards using thermal degradation or electric current to convert solid waste to liquid fuels, syngas, biogas, heat, electricity, and/or chemical products.

Read key insights driving global demand for sustainable waste management

Government of Canada support

Canadian businesses sold $20.9 billion worth of domestic and export environmental and clean technology goods in 2021, an increase of $1.4 billion (+7.2 percent) compared with 2020. Sales of related services accounted for $12.5 billion, up from $11.1 billion in 2020. To support this growing industry, the Government of Canada has created several resources to help Canadian businesses develop, commercialize, sell, and export their solutions.

Canada’s Clean Growth Hub is an inter-departmental initiative comprised of 17 federal government departments and agencies, including CCC, dedicated to supporting clean technology innovation. Consider it a comprehensive resource for information on funding and services for clean energy and technology endeavors.

Together, the members of the Clean Growth Hub adopt a holistic approach, spanning across government, to foster the development, commercialization, and exportation of cleantech. The Hub plays a pivotal role in helping Canadian companies capitalize on the substantial global clean technology opportunity and facilitates the advancement of clean technology innovators’ projects through:

- An extensive online inventory of cleantech-focused funding programs, services, and opportunities.

- Resources and tools to aid in planning and accessing support for cleantech initiatives.

- Complimentary advisory services to connect innovators with federal assistance.

- Enhanced coordination of federal cleantech programs.

- Collection and analysis of data from federal cleantech initiatives, as part of the federal Clean Technology Data Strategy.

Visit the Clean Growth Hub to learn about upcoming funding and support opportunities, request advice and how to sell cleantech solutions to governments.

Ready to export your cleantech solution?

Each year, CCC contracts for and manages billions of dollars in contracts between Canadian companies’ and foreign governments. If you are a cleantech company that is looking to explore sales to international markets or you are actively preparing proposals in response to foreign government solicitations, CCC can support your efforts.

This post was last updated on October 25, 2023.

Learn more about power purchase agreements (PPAs) and how CCC can support these types of agreements with government buyers.

Learn how how to grow your sales by becoming a Cleantech exporter with CCC to sell your products and services abroad.

Let us help you explore ways that the Government of Canada can help you win more international deals.