Defence market watch: Opportunities for Canadian businesses

Countries around the world spent an estimated $2.24 trillion in 2022 to provide their military forces with the arms, equipment, supplies, technology, and know-how needed to defend their borders and protect their interests. Learn more about the defence sector including procurement trends in key markets, what you need to know to participate in those markets and the resources available to help you do business with foreign militaries.

Global defence spending in 2022

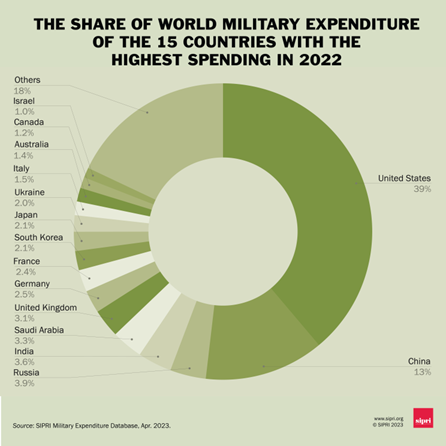

According to the Stockholm International Peace Research Institute (SIPRI), worldwide military expenditure increased by 3.7 percent to $2.24 trillion USD in 2022. The biggest driver for the increase was the war in Ukraine but 2022 also saw increases by nations to support their national security programs. Here are some trends and events worth noting:

- Europe saw its steepest year-on-year increase, 13 percent during the year

- The United States, China and Russia — accounted for 56 percent of the world total

- China increased its military expenditure to an estimated $292 billion in 2022

- Japan’s military spending increased by 5.9 percent, reaching $46.0 billion. This increase supports the country’s plans to increase its military capability in response to perceived growing threats from China, North Korea and Russia

- India’s military spending of $81.4 billion in 2022 was a 6 percent increase from 2021 and was the fourth highest spend in the world

- Military spending by Saudi Arabia, the fifth biggest military spender, rose by 16 per cent to reach an estimated $75.0 billion

- NATO members spent $1,232 billion in 2022, a 0.9 percent increase from 2021 levels

- The United Kingdom had the highest military spending in Central and Western Europe at $68.5 billion, of which an estimated $2.5 billion (3.6 percent) was financial military aid to Ukraine.

- Ethiopia’s military spending increased 88 percent in 2022, to reach $1.0 billion. The renewed government offensive against the Tigray People’s Liberation Front in the north of the country is attributed to the increase

SOURCE: The International Renewable Energy Agency (IRENA)

Current and projected budget

U.S. military spending grew $71 billion in 2022 to an estimated $887 billion USD in 2022. While the war in Ukraine and Israel-Palestine conflict has been in the spotlight, the strategic priorities of the United States Department of Defense (U.S. DoD) is much broader. According to the Secretary of Defense, the U.S. DoD is focused on implementing its National Defense Strategy through:

- Integrated deterrence across domains, theaters, spectrum of conflict

- Campaigning to advance strategy-aligned priorities

- Building enduring advantages to make the Joint Force more resilient/agile.

For integrated deterrence, the FY 2024 budget request (March 2023) was as follows:

- $37.7 billion for modernization and recapitalization of the nuclear triad including funding for the B-21 bomber, a second Columbia class ballistic submarine and the Sentinel missile program.

- $29.8 billion for Missile Defeat and Defense to protect the U.S. homeland, territories, and allies

- $9.0 billion for Long Range Fires

- $61.1 billion for Air Power including fighter aircraft, B-21 bomber, mobility aircraft, tankers, and unmanned aircraft systems

- $48.1 billion for Sea Power including construction of battle force fleet ships, Destroyers, and Guided Missile Frigates

- $13.9 billion for Land Power to modernize combat equipment including Armored Multi-Purpose, Amphibious Combat, and Optionally Manned Fighting vehicles.

- $33.3 billion in vital space capabilities, resilient architectures, and enhanced space command and control

- $13.5 billion for cyberspace activities to defend and disrupt cyber adversaries, transition to Zero Trust cybersecurity architecture, increase defence of U.S. critical infrastructure and industrial base partners against malicious cyber attack.

For campaigning, the FY 2024 budget requests the following to support day-to-day activities and actions, overseas operations, readiness training and exercises, and continuous engagement and collaboration with Allies and partners to advance shared interests:

- $146 billion for modernizing capabilities and sustaining current Joint Force readiness

- $9.1 billion for Pacific Deterrence Initiative (PDI) which includes a new missile warning and tracking architecture and multinational information sharing, training and experimentation

- $4.8 billion for European deterrence activities and countering Russian aggression, support for NATO and aid for Ukraine.

For building enduring advantages, the FY 2024 budget requests monies for innovation and modernization, the defence ecosystem and partnerships, reforms, the climate crisis, pandemic preparedness, and investing in facilities, enhancing deterrence, and improving critical operational infrastructure:

- $145 billion for R&D for responsible artificial intelligence, 5G, and experimentation

- $17.8 billion for Science and Technology including basic research

- Investments to increase production capacity and leverage multi-year procurement to affordably deliver critical munitions

- $5.1 billion to enhance combat capability and mitigate climate risk such as increasing platform efficiencies to mitigate logistics risk in contested environments, hardening critical infrastructure, and deploying new technologies

- $35.9 billion in facilities investments including housing programs and facilities sustainment, restoration, and modernization.

Canadian companies looking to offer their products, services and solutions for the above U.S. DoD programs should search on SAM.gov or Canada’s Global Opportunity Finder (GBOF) to find tenders. Canadian companies interested in advancing their R&D activities can reference CCC’s U.S. DoD Innovation Programs to find in-take programs, especially those that target the Department’s 14 critical technology areas.

U.S. DoD purchases from Canada

There are many opportunities for Canadian businesses to sell to the U.S. military. Canada is a top 10 allied country that supports the procurement needs of the U.S. DoD. In FY 2022, the U.S. DoD had nearly $740 million in contract obligations with Canada. Here is what and how much the U.S. military purchased from Canada between FY 2019 and FY 2023:

$751 million325920 – Explosives Manufacturing | $599 million332993 – Ammunition (except Small Arms) Manufacturing | $497 million325412 – Pharmaceutical Preparation Manufacturing |

$463 million331410 – Nonferrous Metal (except Aluminium) Smelting and Refining | $449 million423940 – Jewelry, Watch, Precious Stone, Precious Metal Merchant Wholesalers | $404 million334511 – Search, Detection, Navigation, Guidance, Aeronautical, and Nautical System and Instrument Manufacturing |

$395 million334220 – Radio and Television Broadcasting and Wireless Communications Equipment Manufacturing | $247 million336413 – Other Aircraft Parts and Auxiliary Equipment Manufacturing | $207 million336412 – Aircraft Engine and Engine Parts Manufacturing |

$204 million336992 – Military Armored Vehicle, Tank, and Tank Component Manufacturing | $62 million334210 – Telephone Apparatus Manufacturing | $58 million336411 – Aircraft Manufacturing |

$58 million337214 – Office Furniture (except Wood) Manufacturing | $56 million541330 – Engineering Services | $52 million333923 – Overhead Traveling Crane, Hoist, and Monorail System Manufacturing |

$44 million332992 – Small Arms Ammunition Manufacturing | $41 million481211 Non-scheduled Chartered Passenger Air Transportation | $41 million334419 – Other Electronic Component Manufacturing |

$39 million511210 – Software Publishers | $38 million334513 – Instruments and Related Products Manufacturing for Measuring, Displaying, and Controlling Industrial Process Variables | $36 million333120 – Construction machinery manufacturing |

$35 million333611 – Turbine and Turbine Generator Set Units Manufacturing | $34 million481212 – Nonscheduled Chartered Freight Air Transportation | $33 million336320 – Motor vehicle electrical and electronic equipment manufacturing |

U.S. DoD past expenditures and future priority areas demonstrate that the U.S. DoD relies on Canada for more than traditional defence supplies and there are many opportunities for Canadian companies looking to grow internationally by selling to the U.S. defence market.

Start selling to the U.S. military

R&D priorities and 14 critical tech areas

The U.S. DoD is in an era of accelerated modernization and has identified 14 critical technology areas in its National Defense Science and Technology Strategy (NDSTS) that are needed to create and field capabilities at speed and scale.

Biotechnology | Quantum Science | FutureG Wireless Technology |

Advanced Engineering Materials | Trusted AI and Autonomy | Integrated Network Systems-of-Systems |

Microelectronics | Space Technology | Renewable Energy Generation and Storage |

Advanced Computing and Software | Human-Machine Interfaces | Directed Energy |

Hypersonics | Integrated Sensing and Cyber |

The identification of these critical areas provides opportunities for the U.S. DoD to co-research and co-develop with industry partners and international allies. This means the Department will continue to leverage the broad innovation ecosystem across academia, federally-funded research and development centers (FFRDCs), university affiliated research centers (UARCs), U.S. DoD laboratories, national laboratories, non-profit entities, commercial industry, and other Government departments and agencies.

Canadian companies looking to partner with the U.S. DoD in these critical technology areas should learn more about specific areas of interest for the U.S. DoD and review if any of the U.S. DoD innovation programs provide opportunities to scale and commercialize their technologies.

- Specific areas of interest in U.S. DoD critical technology areas

- U.S. DoD Innovation Programs information

- VIDEO: How to work with U.S. DoD’s Defense Innovation Unit (DIU)

Selling to U.S. military

The Office of the Under Secretary of Defense for Acquisition and Sustainment is responsible for overseeing the procurement activities of the various segments of the U.S. DoD. Individual armed services are supported by their own distinct procurement office which include the:

- Office of the Assistant Secretary of the Army for Acquisition, Logistics and Technology

- U.S. Marine Corps

- Office of the Assistant Secretary of the Navy for Research, Development and Acquisition

- Office of the Assistant Secretary of the Air Force for Acquisition, Technology and Logistics

- United States Coast Guard Acquisition Directorate

In addition to the above procurement offices, more than 30 different DOD agencies are actively engaged in defence procurement, including the following:

- Defense Logistics Agency (DLA), procures many of the supplies and services, including food, fuel, medical supplies and spare parts

- Defense Contract Management Agency (DCMA), provides contract administration services

If you are a Canadian company and considering selling to the U.S. military, you must register with the department to become part of its supplier ecosystem. CCC has a step-by-step guide to help Canadian exporters get registered so DoD buyers can buy from you.

Are you ready to enter this market?

Once you have registered with the U.S. DoD, you can search for opportunities. SAM.gov lists all major U.S. government (including DoD) solicitations, contract awards over USD $25,000, subcontracting opportunities, and foreign business opportunities with the U.S. federal government. Canadian companies can create a free account on GBOF.ca to view all opportunities listed in SAM.gov, as well as government opportunities in 40 other jurisdictions.

- About the U.S. Department of Defense

- CCC’s step-by-step guide: Selling to the U.S. military

- GBOF.ca

Strategy for modernized defence industrial ecosystem

In 2024, the U.S. DoD released its first strategy for ensuring that the U.S. defense industrial base meets the demands of a challenging national security landscape well into the future.

The National Defense Industrial Strategy (NDIS) offers a strategic vision to coordinate and prioritize actions to build a modernized defence industrial ecosystem. It also calls for sustained collaboration and cooperation between the entire U.S. government, private industry, and Allies and partners abroad. The NDIS lays out the U.S. DoD’s big picture goals for the defence industrial base and includes four long-term strategic priorities:

- Resilient supply chains to securely produce products, services, and technologies when needed, quickly and at the scale that is required;

- Workforce readiness to create a sufficiently skilled, and staffed workforce;

- Flexible acquisition including off-the-shelf acquisition to reduce development times and cost and increase scalability;

- Economic deterrence including building mechanisms and processes to grow the defence industrial ecosystem among the U.S. and close international allies and partners.

While much work will need to be done across the U.S. DoD to implement and meet the objectives/metrics of the NDIS, this strategy is another opportunity for commands to leverage Canadian and other allied businesses that are part of a robust industrial base.

Canada is deemed a “domestic source of supply” by U.S. DoD

CCC is the U.S. Department of Defense designated contracting authority for acquisitions from Canada. It helps U.S. DoD access Canadian capabilities and works to strengthen awareness and understanding that Canada is deemed part of the U.S. defence industrial base by DoD. With the release of the NDIS, CCC will continue to explore and support initiatives that support the Canada-U.S. defence industrial base.

Get help from CCC to sell to U.S. military

Current and projected budget

The United Kingdom Ministry of Defence (MoD) is one of the biggest public procurement organisations in Europe, which in 2021/2022 spent £45.9 billion ($58 billion USD) on the military. There were renewed calls for an increase to defence spending following Russia’s invasion of Ukraine.

To meet this demand, the country allocated an additional £5 billion to defence spending over the next two years (2023/2024 and 2024/2025), and a further £2 billion per year in subsequent years up to 2027/2028. This increases defence spending by a total of £11 billion over this five-year period.

The UK is one of just nine of NATO member countries to have met this target in 2022, spending 2.1 percent of GDP on defence. It also has set a longer-term ambition to increase defence spending to 2.5 percent of GDP but no timeframe has been given for achieving this goal.

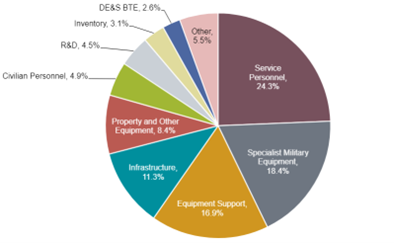

In terms of where the MOD spends its budget, in 2021/2022 year, 29.3 percent of MOD expenditure was on personnel costs. Capital projects covering procurement of Specialist Military Equipment accounted for 18.4 percent of the budget while Equipment Support accounted for 16.9 percent. Infrastructure accounted for 11.3 percent of the budget and Property and Other Equipment used 8.4 percent of budget.

SOURCE: Defence Expenditure by Commodity Block in 2021/22

R&D priority areas

R&D only accounts for 4.5 percent of the MOD budget and in January 2023 the department stated that it will invest at least £6.6 billion in research and development (R&D). Programmes and projects will be delivered by the Defence Science and Technology Laboratory (Dstl), but partners in industry and academia will be crucial to delivery and there will be funding and opportunities to collaborate.

The Dstl have identified 25 programmes of focus and below are some of the most applicable programs to military/defence applications are listed below.

- Advanced Materials programme focuses on 3 key technology areas: low observable materials, materials for extreme physical environments including in oxidising, vibration and fatigue, impact and shock, radiation, vacuum, water depth, erosion and accretion factors, and materials for the contested electromagnetic environment for antenna functionality and integration into platforms.

- Artificial Intelligence (AI) programme draws mainly from the AI and Data Science strategic capability but will also focus on robotics and autonomous systems, human and social sciences, information systems, cyber and electromagnetic activities.

- Air Systems programme is focused on solutions like air operational analysis and decision support; development of air system technologies such as propulsion, structures, aerodynamics, flight control, weapons integration, mission systems and autonomy, survivability and platform protection; air autonomous system and system-of-systems; air vehicle survivability analysis, modelling and simulation; and air signature management, technologies, concepts and control measures to mitigate radio frequency (RF), electro-optical/infra-red (EO/IR) and acoustic threats.

- Autonomy programme is looking to drive generation-after-next autonomous system, provide the means to operationalise robotic and autonomous systems safely and securely, and identify and address common barriers to operationalising autonomy using robotics and autonomous systems (RAS).

- Chemical Biological and Radiological (CBR) Defence programme is focused on diagnostics and medical countermeasures, sensing, situational awareness, counter-proliferation, analysis and attribution, operational response, radiation protection, hazard assessment and management, and physical protection.

- The Communications and Networks programme will be investing in potential solutions to these challenges, from the novel use of the electromagnetic spectrum, alternative communications mechanisms, adaptive and autonomous networks, and novel data routing algorithms, to improve the availability of secure information to military systems and decision-makers at the time and place of need. Activities will focus on C5I convergence and integration, architectures for resilient networks and data services, resilient communications bearers and waveforms, technologies for future beyond-line-of-sight communications.

- The Cyber Security programme moves beyond identification of vulnerabilities and protection and detection of cyber events, towards technology enabled automated response and recovery. Capabilities of interest include cyber security, data science, human science, operational research, systems thinking, software engineering, radio frequency engineering and applied mathematics.

- The Defence Science and Technology Futures programme is focused on exploring technologies that will deliver operational advantage and include robotics, room temperature semiconductors to improve energy efficiency or reduce energy consumption, acoustic protection to improve the reliability of magnetic legacy hard disk drives (HDD), granular fluid based suspension for damping and suspension mechanisms to improved ride comfort and reduced noise levels for our servicemen and women and high-efficiency electrolysis to replace current fossil fuel based propulsion or energy generation systems.

- The Deterrent and Submarine Systems programme is looking for modelling and simulation, sensing, communication and stealth and survivability solutions to enhance their capabilities in strategic systems, ballistic missile defence and underwater capability.

- The Electromagnetic (EM) Activities programme is looking for solutions to identify and exploit vulnerabilities in EM systems and standards to disrupt and degrade adversary capabilities, degrade adversaries’ situational awareness, increasing resilience against evolving threat technologies, providing tactical situational awareness and characterising adversary EM activities to enable precision electronic attack and enable rapid prototyping and assessment of EM concepts and technologies.

- The Future Kinetic Effects and Weapons (FKEW) programme aims to drive highly innovative weapons technologies and areas of interest include advanced missiles and collateral effects, directed energy weapons and effects and tactical effects including non-lethal weapons.

- The Future Sensing programme is focused on photonics and electronic sensing, distributed coherent multi-modal multi-domain sensing, sensor fusion and signal processing, quantum sensing, assured position, navigation and timing (PNT), and resilient sensing in contested and congested environments.

- The Hypersonics programme is focused on developing hypersonic weapons concepts and technology and is looking for weapons systems and advanced materials.

- The Land Systems programme is focused on achieving technological and operational advantage through systems integration of crewed and uncrewed systems or human-machine teaming using sensor to effector technologies. It is also looking for enhanced situational awareness and information exploitation and increased lethality and survivability.

- The Maritime Systems programme is involved in a wide mix of capabilities including analytical engineering and scientific skillsets spanning expertise across above and underwater capabilities.

- The Missile Defence Science and Technology Programme funds research and development of solutions like hypersonic glide vehicles and hypersonic cruise missiles.

- The Security Systems Programme is focused on countering explosive threats, devices and associated systems and is looking to tackle challenges like locating, detecting and identifying illicit substances (such as explosives and narcotics) and improvised explosive devices (IEDs), developing electronic countermeasures, improving modelling and simulation of explosive effects and applying forensic science for specialised and challenging scenarios.

- The Space Systems Programme is tasked to focus on space situational awareness, novel technologies for satellite communications, evaluation of threats in Space (both natural and manmade) to military capability and the development of mitigations and resilience measures, novel technologies for Space-based intelligence, surveillance and reconnaissance (ISR) and launch to orbit trajectory modelling capability to enable UK-based access to space.

- The Specialist Systems Programme promotes options to support strategic operational advantage for the Specialist Users (SU) and is looking for capabilities like above water systems, communications and networks, homeland security and counter-terrorism systems, operational research, robotics and autonomous systems, sensing, survivability, underwater systems and weapons

- The Support and Sustainability Programme is focused on solutions that address current sustainability issues and emission targets; using future energy technologies, data science, autonomy and automation and additive manufacturing for defence logistics and support; power and energy solutions to optimize the performance, reducing the costs and enabling new or enhanced effects of military equipment; and rapidly test and evaluate (T&E) new technologies with confidence.

Selling to the UK MoD

The variety of products and services required, coupled with the sheer size of expenditures, makes the UK military an attractive market for Canadian companies of all types and sizes in which to grow their business.

The UK MoD is one of the biggest public procurement organisations in Europe and the single largest customer for UK industry. It is committed to spend £190 billion on equipment and support over the next decade for the armed forces and national security agencies. There are a few organizations that are responsible for UK MoD procurement including:

- Defence Equipment and Support (DE&S) buys, supports, and supplies vital equipment and services that the Royal Navy, British Army and Royal Air Force and buys everything from jets and warships through to armoured vehicles and field kitchens.

- Defence Infrastructure Organisation (DIO) is responsible for planning, building, maintaining, and servicing infrastructure.

- Defence Digital is responsible for delivering effective digital and information technology and is the lead on defensive cyber strategy, capability development and policy, and supplying IT services.

- Defence Science and Technology Laboratory (Dstl) supplies sensitive and specialist science and technology services for MOD and wider government.

- Team Leidos provides global freight service and procurement and inventory management of food, packed fuels, clothing, medical materiel and general supplies.

- Strategic Command delivers medical services, training and education, intelligence and information systems across land, sea, air, space and cyber domains. They also manage overseas joint operations.

- Submarine Delivery Agency (SDA) manages the procurement, in-service support and disposal of UK nuclear submarines.

The UK MoD has its own set of procurement processes and regulations. The Ministry publishes a wealth of helpful orientation materials on its Defence Sourcing Portal (DSP), which serves as a one-stop-shop for contract opportunities, tendering, and information on doing business with the MoD.

Tender and contract opportunities valued over £10,000 are advertised on DSP. Access and registration to bid for MOD opportunities on the DSP is free of charge, and suppliers are also able to publish their sub-contracting opportunities on the portal. DSP opportunities are also advertised on UK’s Contracts Finder.

Are you ready to enter this market?

Canadian companies looking to find opportunities with UK MoD posted on the DSP and Contracts Finder can register for a free account on the Global Bid Opportunity Finder (GBOF) to search for opportunities in the UK and in 40 other jurisdictions with just one account.

Talk to CCC about an opportunity with the U.K. government.

Current and projected budget

In 2022, defence expenditure of the 27 European Member States increased for the eighth year in a row to €240 billion. Sweden, Luxembourg, Lithuania, Spain, Belgium, and Greece recorded the highest increases in overall expenditure among Member States. A record €58 billion was allocated to defence investments (R&D and procurement of defence equipment) of which most was spent on the procurement of new equipment.

The European Defence Agency (EDA) also had a significant jump in value of projects it managed. In 2022 it started 18 projects worth more than € 76 million, for a combined value of € 250 million across 46 projects managed on behalf of Member States.

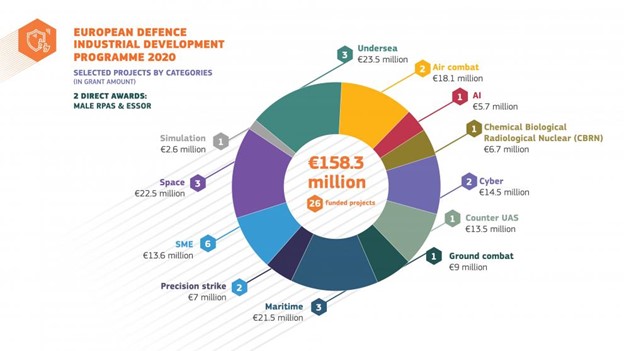

One program of interest to companies is the European Defence Industrial Development Programme (EDIDP), which supports the competitiveness and innovation capacity of the Union’s defence industry. With a financial envelope of €500 million for 2019-2020, the EDIDP was the first ever EU grant programme targeting capability development and co-financing the joint development of (new and upgrading of existing) defence products and technologies.

The programme is implemented, except in the case of direct awards, under direct management by the Commission through annual calls for proposals. Only collaborative projects, involving at least three eligible entities from at least three Member States may receive funding. Participation of entities from other countries is subject to conditions defined to ensure the security and defence interests of the EU and its Member States. They also guarantee the freedom of action of Member States in the use and export of resulting defence equipment.

The 12 categories of the EDIDP 2020 calls are as follows:

Chemical Biological Radiological Nuclear (CBRN) |

|

Underwater control |

|

Counter-Unmanned Air Systems (UASs) |

|

Cyber situational awareness and defence, defence networks and technologies |

|

Space Situational Awareness (SSA) and early warning capabilities |

|

Maritime surveillance capabilities |

|

Ground-based precision strike capabilities |

|

Ground combat capabilities |

|

Air combat capabilities |

|

Simulation and virtualisation |

|

Artificial intelligence (AI) |

|

SME – Innovative and future oriented defence solutions |

|

SOURCE: European Defence Industrial Development Programme (EDIDP)

R&D priority areas

The EU Capability Development Plan is the central reference for defence planning in the EU and is used for all European defence-related initiatives, such as the Coordinated Annual Review on Defence (CARD). The 2023 review of the CARD results in 14 priorities across the five military domains, and a further 8 priorities categorised under strategic enablers and force multipliers.

Land

| Air

| Maritime

|

Space

| Cyber

| Enablers & Force Multipliers

|

Looking at specific research & technology (R&T) initiatives, here is a summary of ten of the projects currently led and supported by the EDA:

- Air-to-air refueling focuses on optimization of existing assets, A400M AAR capability, Strategic Tanker Capability (MMF) and development of Automated AAR (A3R).

- CapTech Aerial Systems (CapTech Air) promotes R&D in the aerial systems and covers areas like propulsion and command and control (C2) air domain network, unmanned aerial vehicles, cooperative unmanned vehicles, and manned and unmanned teaming, system diagnostics, fault prognostics, and self repair.

- CapTech CBRN and Human Factors’ (CBRN & HF) is focused on strengthening of European armed forces’ capability to safely operate in a CBRN environment while contributing to civilian-led crisis response operations if needed. Underlying technologies that are of focus include personal protective equipment; detection, identification, and monitoring of CBR; CBRN hazard management; CBRN modelling & simulation; protection of critical infrastructure from CBRN; protection of food & water supply from CBRN; and assessment, diagnosis and medical countermeasures of CBR hazards.

- CapTech Energy and Environment focuses on activities related to energy and environment systems, energy security and dependence on fossil fuels, resources security of supply, water security, energy efficiency, renewable energy sources, waste management and environmental change and protection.

- CapTech Maritime addresses naval platforms, both surface and underwater, including Unmanned Maritime Systems and integrated systems (including sensors, weapons, energy propulsion, etc.), addressing their design, integration, and life-cycle improvement.

- CapTech Missiles and Munitions focuses on energetic Materials (propellants, explosives and pyrotechnics); lethality & platform protection (penetrators, warheads and battle damage assessment) ; propulsion of munitions and missiles; design technologies for platforms & weapons (ballistic design); sensor systems (explosive detection) and weapons.

- CapTech RF Sensors Technologies (RADAR) deals with Radar and Electronic Warfare (EW) systems applying radio frequency (RF), magnetic and electronic technologies.

- CapTech Space activities contribute to space-based information and communications services (Earth observation, Positioning, Navigation and Timing, Space Situational Awareness, Satellite communication); information superiority (radio spectrum management, tactical communications and information systems, information management, and ISR capabilities); air superiority (e.g., Ballistic Missile Defence); cyber defence (including in space).

- CapTech Information covers R&T needs in the areas of communication systems from devices to networks; information systems from data acquisition and processing to fusion and presentation; ubiquitous mobile, ad-hoc and networked computing; semantic technologies; smart and efficient communications; management of information at large scale (e.g. for wireless sensor networks); user-friendly presentation of information and controls; and common system interoperability including multi-layer information gateways.

- CapTech Materials & Structures covers the following material categories: signature materials; energy and energy harvesting; replacement materials; structural materials; emerging materials; manufacturing technology; non-destructive testing; in-service performance; REACH compliance; surface treatments; modelling and protection (armour).

Selling to the EU

In 2023, the Council of the European Union reached a provisional agreement with the European Parliament to incentivise EU member states to jointly procure weapons to promote interoperability, economies of scale and a stronger European defence industry. Member states who agree to pool their demand and jointly procure defence products with at least three countries will be partially reimbursed from the EU budget.

Opportunities with the European Defense Agency on its procurement page. They are also posted on TED, the European eTendering site, which includes tenders from many European agencies including European Commission, DG Defence Industry and Space (DEFIS), European Border and Coast Guard Agency (Frontex), European Commission, DG Energy (ENER) and more.

Are you ready to enter this market?

Canadian companies looking to browse for opportunities on TED can either register and search directly on the TED site or create a free account on the Global Bid Opportunity Finder (GBOF) to search for opportunities in Europe, United States, UK and 40 other jurisdictions with just one account.

Talk to CCC about an opportunity with an EU government

Current and projected budget

NATO is increasing its military budget for 2024 by 12 percent to 2.03 billion euros and its civil budget by 18.2 percent to 438.1 million euros. The increase will allow the organization to address shared security challenges more effectively.

The NATO Support and Procurement Agency (NSPA) provides acquisition and logistics support to NATO, its Allies, partners, and other international organisation and focuses on NATO operations and exercises; life-cycle management of weapons systems; and management and coordination of the Central Europe Pipeline System. The organization also:

- Manages contracts for fuel, oil supplies and port services for naval shipping

- Procures, manages, operates, and maintains deployable camp infrastructure and associated contracted services for NATO and its Allies, through its Southern Operational Centre (SOC)

- Implements NATO Trust Fund projects, supporting security and defence-related projects and building capabilities in partner countries

- Oversees all phases in life cycle of equipment and weapons systems

- Manages 32 multinational support partnerships covering over 90 major weapons systems (helicopters, radars, missiles, armoured vehicles, airborne surveillance systems, etc.), including high-visibility projects such as Alliance Future Surveillance and Control (AFSC), Multinational Multi-Role Tanker Transport (MRTT) Fleet (MMF), Alliance Ground Surveillance (AGS), Precision Guided Munitions and Land Battle Decisive Munitions, Land Combat Vehicles and Equipment, Ground Based Air Defence (GBAD), Strategic Airlift International Solution (SALIS)

Selling to NATO

Companies interested in selling to the NATO must be from a participating NATO Nation funding the requirement. Tender opportunities (also called International Competitive Bidding, ICB) with NATO are advertised on a number of sites including the NCIA bulletin board (English only) and NSPA procurement website. Details of all NATO business opportunities notified to the Canadian delegation are posted on the PWGSC website.

For procurements under €160,000, the Agency will normally follow the Simplified Procurement procedures where qualified sources that are known to meet the requirements are solicited.

Are you ready to enter this market?

Register your interest to bid: When a Canadian company sees a Notification of Intent to Invite Bids (NOI) of interest, they should contact the Canadian delegation at NATO and request that a Declaration of Eligibility (DOE) be forwarded to the host nation. This will allow the Canadian company to be added to the bidders list for the project and to receive the formal Invitation for Bids (IFB) package.

Companies cannot submit the DOE themselves. The only exception is for Basic Ordering Agreement (BOA) procurements, where the original declaration issued for the BOA is valid for all subsequent bids made using that BOA agreement.

Monitor when invitations for bids are released: Once an invitation is released, the time allowed for submission of bids is not less than 84 days for large-scale or complicated projects or 42 days for others.

Ensure clear bid pricing: Bidding companies need to price to meet the Minimum Military Requirement (MMR) and no more. Providing an alternative solution, but not explaining how it meets the MMR, will result in non-compliance, and your bid will be rejected on legitimate grounds. You need to make your cost breakdown clear. If providing alternative solution options, make your base price clear, with additional costs per option.

Submit bid on time: Bid deadlines are fixed, but in certain circumstances a delegation can request an extension on specific grounds. Host nations only give one extension at a time and will not accept late submission of documents if an extension has not been formally notified by a delegation and confirmed to all parties.

Evaluation methods: Lowest-Price, Technically-Compliant (LPTC), also known as “Lowest Compliant” is nearly always used for Simplified Procurements, BOA competitions and ICBs with known, firm requirements.

For ICBs and larger BOA competitions: the evaluation includes an administrative, price and technical evaluation. The Pass-Fail evaluation is used for administrative requirements. For the pricing evaluation, the review ensures that the price volume is complete, and the prices bid are reasonable. The bid evaluated as the lowest price undergoes the technical evaluation.

For the technical evaluation: there is no technical scoring or consideration given to “extra features”. If the lowest price bid is compliant with all the technical requirements, that company is selected for the project, and the other technical bids are not evaluated. If it is determined to be non-compliant, the second lowest price bid is then evaluated.

- Guide to navigating NATO procurement

- How to bid on NATO contracts – and win

- Talk to CCC about an opportunity with NATO

Current and projected budget

According to SIPRI, total military expenditure by countries in the Middle East was an estimated $184 billion in 2022. Saudi Arabia is by far the biggest spender with $73 billion spent on defence in 2022. Israel’s military spending in 2022 was $23.3 billion but that number is expected to change with the recent conflict in Gaza and Lebanon. Here is how much the top 10 defence spending countries in Middle East and North Africa spent in 2022 ($USD):

Egypt$5.2 billion | Iran$5.6 billion | Iraq$4.4 billion | Israel$23.3 billion | Jordan$2.2 billion |

Kuwait$8.0 billion | Oman$5.6 billion | Qatar$14.8 billion | Saudi Arabia$73.0 billion | Türkiye$11.5 billion |

SOURCE: SIPRI Military Expenditure Database

Selling to Saudi Arabia

According to the 2023 budget released by the Saudi Arabia Ministry of Finance, the country will increase its military spending by 50 percent to $69 billion in 2023 to help meet it’s Saudi Arabia’s Vision 2030 goals and requirements to localize 50 percent of government spending in the defence sector.

Saudi Arabia’s military budget funds various government bodies, research and development, military training and development, military health services, and military cities and bases. Key projects include construction of facilities at the King Salman Airbase, the relocation and establishment of the King Faisal Air Academy, the modernization of the Ministry of the National Guard, and the continued localization of 50 percent of defence procurement expenditures.

Saudi Arabia’s Procurement Law regulates all government procurement. Government tenders are posted on the country’s procurement portal, Etimad, which serves as a centralized repository for all government tenders. Companies can also search other portals, such as the Saudi Ministry of Investment (MISA), Bureau of Industry, Ministry of Defense (MOD), Saudi Arabian Military Industries (SAMI), and General Authority for Military Industries (GAMI).

According to the U.S International Trade Administration, Saudi Arabia’s Ministry of Investment publishes and periodically reviews a negative list of business functions that foreign companies are unable to undertake. In 2020, catering to military sectors was part of the list, however, international companies and contractors have been able to carry out ancillary services after selling military systems to the government, including maintenance, repair and overhaul (MRO), training, spare parts, mounting and installation of equipment and technical support.

Companies looking to do business in Saudia Arabia must ensure they have the appropriate permits and licenses and/or elect to have a local partner or establish a joint venture. Companies pursuing government tenders should verify requirements with the relevant authority.

Most companies elect to have a local partner or establish a joint venture. But one of the challenges that foreign defence firms face is the legal prohibition on paying commission fees to agents for the sale of military equipment to Saudi Arabian government agencies. Companies can engage a local agent and comply with the law by offering such agents payment of success fees comprised of fixed one-time payments each time a contract is awarded, or by hiring the agent as an employee and remunerating the agent through an adjusted salary scale. Another option is establishing a joint venture company with a Saudi partner where a local partner focuses on business development and winning government contracts.

The Ministry of Investment announced that by 2024, all international companies would be limited in doing business with the government unless their regional headquarters are in Saudi Arabia. Companies pursuing tenders should verify requirements with the relevant authority.

Are you ready to enter this market?

Talk to CCC about a government opportunity

Current and projected budget

According to SIPRI, total military expenditure by Asian and Oceania countries was an estimated $596 billion in 2022. China is by far the biggest spender with $292 billion spent on defence in 2022. Other power spenders include India, Japan, South Korea and Australia Here is how much the top 8 defence spending countries in Asia and Oceania spent in 2022 ($USD):

Australia$32.3 billion |

China$292 billion |

India$81.4 billion |

Japan$46 billion |

Pakistan$10.3 billion |

Singapore$11.2 billion |

South Korea$46.4 billion |

Thailand$5.7 billion |

Source: SIPRI Military Expenditure Database

Australia defence sector

The Australia Government released its latest Defence Strategic Review in 2023 which includes specific directions to defence with immediate effect, while establishing a methodical and comprehensive process for long-term and sustainable implementation. Immediate priorities identified in the Defence Strategic Review, including:

- $9 billion for the nuclear-powered submarine program through the AUKUS partnership.

- $4.1 billion for long-range strike capabilities.

- $3.8 billion for northern base infrastructure.

- $900 million on defence innovation.

There are many organizations that are investing in emerging technologies including:

- The Advanced Strategic Capabilities Accelerator (ASCA) aims to accelerate the acquisition of technology, especially from the private sector and research institutions. Priority capabilities for ASCA include hypersonics, directed energy, trusted autonomy, quantum technology, information warfare and long-range fires.

- The Defence Science and Technology Group (DSTG) creates opportunities for partnerships between industry, academia and government to deliver future-focused defence technologies on key focus areas including surveillance and space technologies; chemical, biological and radiological and nuclear (CBRN) defence; robotics and automation; cyber and operations analysis.

- Trusted Autonomous Systems (TAS) is focused on growing Australia’s defence capability in advanced autonomous and robotic technology.

- The Commonwealth Scientific and Industrial Research Organisation (CSIRO) has expertise in defence research spanning early development to testing. Projects include the Queensland Centre for Advanced Technologies, the Artificial Intelligence roadmap, Bluelink ocean forecasting, and DARPA Challenge.

Are you ready to enter this market?

The Australian Government Defence has a wealth of information on its procurement framework, panel arrangements (standing offers), and contracting templates that are useful for any company looking to bid on a government bid in Australia.

Project opportunities are advertised via tender and can be found on the AusTender. Canadian companies can also register for a free account on Canada’s Global Bid Opportunity Finder (GBOF) to search for opportunities in Australia, United States, Europe and 40 other jurisdictions with just one account.

Talk to CCC about an opportunity with the Government of Australia

Singapore defence sector

Singapore’s MINDEF/SAF is responsible for defence acquisitions and updating the public and Parliament of our potential future purchases. The organization has a robust and comprehensive procurement process, with strict procedures that ensure that procurement adheres to standards.

The Defence Science and Technology Agency (DSTA) is responsible for all aspects of the Singapore’s defence procurement process such as contract preparations, pricings and risks, identification of contractors, as well as the evaluation of tenders received, and the subsequent contract award. To do business with the DSTA, consider introducing your company, products or service.

Are you ready to enter this market?

- Register as a GeBIZ Trading Partner (GTP): All public sector invitations for quotations and tenders, including those with MINDEF and DSTA, are posted in GeBIZ. All potential suppliers should register as a GeBIZ Trading Partner (GTP).

- Register as a Government Supplier with the Ministry of Finance: Suppliers who wish to bid in tenders for the supply of goods and/or services, disposal and sales of retired stores and equipment to the government are advised to register as a Government Supplier with the Ministry of Finance.

- Register with the Building and Construction Authority: Companies that wish to participate in construction or construction-related government tenders must be registered with the Building and Construction Authority (BCA), unless otherwise specified in the tender.

- Read about Singapore’s defence procurement: Read about the country’s principles of transparency, fairness and value for money.

Canadian businesses looking to learn more about doing business in Singapore should contact Canada’s Trade Commissioner Service.

South Korea defence sector

South Korea has allocated $48.3 billion for its 2023 defence budget. It contains $33.9 billion for force operations which includes expenditure for military logistics, facilities, and education and training of military forces and $14.3 billion for defence capability improvement which includes securing advanced weapon systems.

The Defense Acquisition Program Administration (DAPA) is responsible for Korean defence procurement and uses a sophisticated and mature procurement system which includes direct purchase, sales agents, and importer channels. Foreign defence products and services companies should use a well-qualified/vetted Korean agent, familiar with the country’s defence system and agencies. Companies wanting to supply their products/systems to Korea’s military are required to register with DAPA – visit https://www.dapa.go.kr to learn more.

For Canadian companies, the Canada-Korea Free Trade Agreement (CKFTA) eliminates tariffs for Canadian defence and security products including aerospace products and information and communications technology products. Several South Korean agencies are covered under the CKFTA, including the Korean Ministry of National Defence, the Defence Acquisition Program Administration, and the Korea Coast Guard and the agreement provides secure and predictable access to covered procurement opportunities above a contract value of approximately $100,000.

Are you ready to enter this market?

Canadian businesses looking to learn more about doing business in South Korea should contact Canada’s in-country Trade Commissioner Service ([email protected]).

While the U.S. account for the bulk of defence spending in the Americas, Latin America presents some opportunity for companies positioned to capitalise in this region. In 2022, defence spending in Latin America was $55.9 billion (not including Venezuela, Panama and Costa Rica).

Brazil defence sector

Brazil (with a 2022 military spend of $17.7 billion) remains the one country in the region with substantial ongoing defence procurement to control illicit activities such as organized crime, cross-border drug trafficking, and arms smuggling, as well as meeting modernize plans.

Defence programs include the submarine development program (PROSUB), the navy nuclear program (PNM), SIVAM/SIPAM amazon surveillance system projects, the SiMCosta coastal surveillance system project, the Brazilian Gripen program, and the VBTP-MR Guarani Project.

In terms of specific procurement projects, the Brazilian Army is acquiring self-propelled howitzers and upgrading armoured vehicles while the Air Force has expanded its order of F-39 E/F Gripen fighter jets. The Navy has outlined plans to procure patrol vessels, frigates, surveillance systems, logistical support ships, and unmanned aerial vehicles.

Are you ready to enter this market?

Talk to CCC about a Government of Brazil opportunity

Colombia defence sector

As a result of ongoing domestic security problems including high coca production, public safety issues due to guerilla and criminal organizations and the socio-economic impact from Venezuelan migrants, Colombia spent $10.3 billion on its military in 2022.

Most of the country’s defence budget is designated for operational activities, but about four percent of the total budget will be invested in strengthening the security and strategic capacity of the Armed Forces. This includes the purchase of equipment, hardware, weapons, ammunition, and communication upgrades, and to carry out major scheduled maintenance or replacement for aging equipment.

According to the International Trade Administration, specific areas of interest to Colombian defence commands include:

- Small arms and ammunition: including rifles, pistols, and machine guns. They are also looking to acquire new types of ammunition, such as armor-piercing rounds and high-explosive rounds.

- Armored vehicles: tanks, armored personnel carriers, and armored trucks

- Aircraft: fighter jets, attack helicopters, and transport aircraft

- Sustainment: Upgrades, parts, and support for Blackhawk, Huey, Airbus, Bell, Cessna, ATR, CN 235, and ATR-42 fleets

- Naval vessels: Acquisition of riverine and maritime watercrafts, such as frigates, corvettes, and patrol boats, as well as maintenance of naval assets docks and facilities, ammunition, batteries for torpedoes, navigation systems, field equipment, amphibious vehicles, and steel for shipbuilding.

- Artillery: modernization of existing equipment and possible purchase of additional systems

- Communication and intelligence equipment: radio communication systems, radars, and surveillance systems.

- Command-and-Control Centers: construction of Command-and-Control Centers in Bogota and other cities

- MOD Headquarters: Construction of the new headquarters for the security, and defence sector, technological services, integrated communications, cyber defence capabilities, cybersecurity material, and data centers

- Tactical and survival equipment: armored vests, helmet and riot shields, grenades, among others

- Technological equipment: ballistic fingerprint information systems, portable radios, predictive crime models, among others

- Signals intelligence: upgrade of aerospace capabilities, SIGINT, and COMINT from space

- Technology transfers, data center services, COC, software, and hardware, cybersecurity

- Equipment for demining, especially light hand-held devices to be used in rugged terrain

- Equipment for manual eradication of illicit crops

- Combat material and equipment for special forces, anti-explosive groups, and information and communication technologies to integrate intelligence information systems

- High tech medical equipment and devices

Are you ready to enter this market?

Imports of defence equipment is done via state-owned entities; INDUMIL (arms, ammo, explosives), CIAC (aviation), CODALTEC (technology), and COTECMAR (naval). All security and defence purchases for the Colombian Armed Forces are made through tenders publicized in Colombia Compra Eficiente, private invitations, and the Colombian Air Force Purchasing Agency (ACOFA). Canadian companies are invited to view opportunities listed in these portals.

Talk to CCC about a government opportunity

Chile defence sector

Chile is another country in the region showing signs of investment in defence modernisation, with a focus on dual-purpose equipment that can be used for peacekeeping and humanitarian purposes, as well as, managing internal security threats and territorial disputes. In 2022, the country spent approximately $5.6 billion on its military.

Specific projects include investments in submarine capabilities, naval logistics, and military transport vessels to strengthen maritime capabilities. The Air Force is also considering the acquisition of the C-390 Millennium aircraft.

Are you ready to enter this market?

ChileCompra is the central source for all Chilean government procurement, including the armed forces. To participate in public tenders, all companies must register free of change on MercadoPublico. All bidders must post a bank and/or guarantee bond, usually equivalent to ten percent of the total bid, to ensure compliance with specifications and delivery dates. Bidding is best done through a local agent who is registered, well connected, and familiar with Chilean government bidding procedures.

Canadian companies looking for government opportunities in Chile can create a free account on GBOF.ca and view upcoming opportunities in Chile and 40 other jurisdictions.

Talk to CCC about a Government of Chile opportunity

Download our guide to learn how Canadian companies can leverage international military procurement trends to sell into global defence markets.

Selling into international markets isn’t easy. But you’re not alone. CCC operates at the junction of commerce and international relations to deliver Canadian made solutions to governments around the world. Through our international contracting expertise, we support Canada and Canadian businesses to build successful commercial relationships with governments around the world.

We offer support for a range of sectors, with a strong focus on solutions for the U.S. Department of Defence (U.S. DoD) and foreign governments looking to procure solutions in aerospace, defence, construction and infrastructure, clean technologies, and Information and communications technology (ICT). We are here to help Canadian businesses to sell to foreign militaries through our two signature services – U.S. DoD Prime Contractor and International Prime Contractor.

U.S. DoD Prime Contractor

CCC administers the Defence Production Sharing Agreement (DPSA) and is embedded in the U.S. DFARS regulations 225.870 as prime contractor for all contracts over $250,000 USD. We help Canadian exporters of all sizes win U.S. DoD opportunities, for both traditional and non-traditional military goods. We also help U.S. DoD buying commands to procure from Canada.

Here is why you should work with CCC:

For Canadian Exporters

| For U.S. DoD Buyers

|

International Prime Contractor

International Prime Contractor is a fee-based program where we create government to government (G2G) contracts to help Canadians win more international business and government buyers meet their public sector commitments. Here is what we do when building G2G contracts with foreign defence buyers:

- Pairing qualified Canadian solution providers and international government buyers

- Validating sales leads and assigning MOUs with government entities

- Defining requirements and paving the way for a proposal

- Submitting and endorsing unsolicited Canadian company proposals

- Negotiating the contract, coordinating advocacy and undertaking the role of Prime Contractor

- Issuing a domestic contract to the Canadian company and managing contract performance

- Providing a Government of Canada guarantee that the contract will be carried out as agreed.

Here is why you should work with CCC:

For Canadian Exporters

| For International Government Buyers

|

In addition to CCC, here are some other Government of Canada partners who help Canadian businesses to sell to defence departments around the world.

- Trade Commissioner Service (TCS) helps Canadian companies navigate international markets, including the United States. TCS has trade commissioners around the world and online resources. CanExport is a funding program for Canadian SMEs seeking to develop new export opportunities, particularly in high-growth priority markets and sectors.

- Export Controls Online allows exporters to submit applications for export permits and certificates, as well as request amendments. Export and Import Controls provides up-to-date information on controlled products as well as how to obtain the necessary permits and certificates.

- Department of National Defence offers several programs for Canadians. Innovation for Defence Excellence and Security (IDEaS) provides five funding mechanisms to assist Canadian innovators in solving defence and security challenges.

- Public Services and Procurement Canada (PSPC) serves federal departments and agencies and their central purchasing agent(s). PSPC Industrial Security Sector (ISS) plays a critical role in administering the Controlled Goods Program (CGP). PSPC Price Services Support Sector (PSSS) assists with price certification and audits for U.S. DoD contracts at the request of CCC or the U.S. DoD.

- Joint Certification Program (JCP) certifies Canadian and American contractors to bid and work on contracts and conduct research requiring access to militarily critical technical data.

- Canadian Association of Defence and Security Industries (CADSI) is dedicated to representing more than 900 defence and security companies, advocates on behalf of the defence industry and provides assistance for members to reach their goals.

- Aerospace Industries Association of Canada (AIAC) advocates on aerospace policy issues that have a direct impact on aerospace companies and aerospace jobs in Canada.

Sell to global defence markets today

CCC is Canada’s government to government contracting agency. For over 75 years, governments around the world have entrusted us to reliably deliver made-in- Canada products and projects of public and national security importance.

Acting as prime contractor, we simplify and expedite acquisitions from Canadian suppliers across a wide range of sectors including aerospace, defence and security, information and communications technology (ICT), cleantech and energy, and public infrastructure. Learn more about how we support Canadian companies and government buyers in their pursuit of defence and national security solutions.

This post was last updated on February 29, 2024.

Learn about what makes the U.S. DoD so attractive and what Canadian exporters should know about pursuing opportunities with the U.S. military.

Learn about government procurement markets, sales opportunities for your business, where to find government contracts for bid, and what you need to know to enter and succeed in this market.

Let us help you explore ways that the Government of Canada can help you win more international deals.