How to sell to European Union governments

The EU has more than 250,000 public contracting authorities across 27 member states —buying a combined $2 trillion on goods and services each year. Here’s what Canadian businesses need to know to tap into this massive market.

The European Union (EU) is the second largest global player in international trade and accounts for about 15 percent of the world’s trade in goods. With a GDP of 17.09 trillion USD and a population of near 450 million, it is an attractive market for Canadian companies looking to export their goods and services.

In the EU, the 27 member countries operate as a single market making it easier to do business, as it allows for free movement of goods between countries. Other reasons the EU is an attractive market for Canadian businesses is that it offers long-term political stability, it has a competitive tax system, and import tariffs are amongst the lowest in the world.

Canada has also forged some special trade relations with the EU that makes the bloc a strong market for Canadian goods, services and expertise. In this blog we provide more information about the EU, and how you, as a Canadian business, can access and succeed in this market.

Canada-EU free trade agreement

The Canada-EU Comprehensive Economic and Trade Agreement (CETA) came into effect on September 21, 2017 and sets new standards for trade in goods and services, non-tariff barriers, investment, government procurement, and other areas like labour and the environment.

It covers virtually all sectors and aspects of Canada-EU trade in order to make it easier for Canadian to do business in the EU. A few benefits of CETA include:

- Reduced tariffs: With CETA, 98% of EU tariff lines are now duty-free for Canadian goods.

- Favourable rules of origin: Canadian exporters have clear and favourable rules that consider Canada’s supply chains to determine which products are considered originating and therefore eligible for preferential tariff treatment.

- Simplified customs and trade: Canada and the EU are working to keep customs procedures simple, effective, clear and predictable to reduce processing times at the border and makes it easier to move goods between countries.

- Reduced regulatory requirements: CETA helps avoid unnecessary or discriminatory regulatory requirements.

- Level-access to government procurement opportunities: Canadian companies can bid on opportunities at all levels of government in the EU, opening trillions in potential business.

- More trade and labour opportunities: CETA provides Canadian service providers with more business opportunities in the EU and makes it easier for certain skilled professionals to work temporarily in the EU.

With CETA, Canadians enjoy a number of benefits that makes doing business in the EU easier, including:

- Competitiveness: Gain preferential access to one of the largest economies in the world.

- Access to new clients: Canadian businesses can now supply goods and services to all levels of EU governments, including governments of EU member states. It also offers new opportunities with regional and local governments.

- Market transparency and stability: CETA sets requirements for product standards, investment, professional certification and other areas of activity. It also includes labour rights and environmental protection.

- Reduced barriers to trade: It is now easier to move goods across borders and for business people to pursue opportunities.

Learn more about CETA benefits for Canadian businesses.

Access to EU government markets for Canadian businesses

The government-procurement chapter in the CETA gives Canadian companies more comprehensive and favourable access to the EU’s procurement market than those of any other G20 country.

In the sectors that the EU has opened and for contracts above a certain value or threshold, EU public authorities are obliged to award the contract to the company (including Canadian companies) that submits the bid with the highest score in the evaluation of specifications and requirements. As long as the bid meets the EU standards, a government body may not discriminate against a Canadian company on the basis of nationality.

The contract threshold values specified in CETA depends on the contracting body and the offering provided by the contract. For the EU institutions and central government contracting authorities of EU Member States, the thresholds are as follows:

- Goods or service contracts: 130,000 Special Drawing Rights (SDR) (€135,000 or $221,400)

- Works contracts: 5,000,000 SDR (€5,225,000 or $8,500,000)

For sub-central entities (regional and local entities, and bodies governed by public law including hospitals, schools, universities and social service agencies), the thresholds are as follows:

- Goods or service contracts: 200,000 SDR (€209,000 or $340,600)

- Works contracts: 5,000,000 SDR (€5,225,000 or $8,500,000)

The EU does not have any “buy-EU” preferences, except when the value of the contract is below stated thresholds. It is also not permissible to have buy-national clauses at the member-state level that discriminate against other EU Member States.

CETA benefits by sector

In addition to providing a more level-field to access government procurement opportunities, CETA provides a boost to certain sectors. According to Global Affairs Canada, almost 94% of EU agriculture tariffs are now duty-free under CETA. For example, EU tariffs on frozen lobster and frozen crab have been removed under CETA, benefitting seafood exporters. Food exports, such as sugar and confectionary, cereals and seafood, have also benefited from CETA.

For aerospace companies, CETA eliminates tariffs on aerospace products and Canadian companies benefit from provisions in CETA related to temporary entry, government procurement, regulatory cooperation and conformity assessment.

For Canadian infrastructure companies, EU tariffs are eliminated on all originating products used in building and maintaining infrastructure such as, construction materials, power generating machinery, electrical equipment, rail products, infrastructure related ICT products and more.

For clean-tech and ICT companies, CETA eliminates EU tariffs on Canadian clean-tech products, provides and equal footing with EU competitors and will receive better treatment than most of their non-EU competitors. Canadian companies also benefit from improved labour mobility provisions, expanded access to EU government procurement opportunities, and the eligibility to test products for European conformity in Canadian facilities.

Sectors that the EU has excluded from CETA include ports and airports, broadcasting, postal services and shipbuilding and maintenance. Canada has carved out the following exceptions: healthcare and social services; cultural industries; Aboriginal businesses; security and defense; research and development; financial services, regional development; recreation, sport and education services; airport and port authorities; shipbuilding and repair; and any procurement made on behalf of non-covered entities.

For other sectorial specific benefits of CETA, Global Affairs Canada has compiled a list of industry-specific business opportunities that is worth exploring.

Canada-EU trade profile

Here is a snapshot of trade between Canada and the EU and how CETA has had an impact on Canadian businesses:

Exports from Canada to the EU grew by 21% from $40 billion in 2016 to $48 billion in 2019. Imports from Canada to the EU grew by 27% from $61 billion in 2016 to $77 billion in 2019.

Total merchandise trade between Canada and the EU reached a record high of €66.8 billion in 2019, equivalent to a 27.0% increase compared to pre-CETA levels in 2016

Since the implementation of CETA, the annual average growth rate of Canada-EU bilateral trade has increased from 4.4% during the period of 2011-2016 to 7.9% in 2018-19.

Foreign direct investment (FDI) made by the EU in Canada increased by 19% from $259 billion to $308 billion in the same period.

Agricultural products represent 9.3% of total bilateral trade and was 14.8% higher in 2019 compared to the pre-CETA levels

Canada’s agri-food and seafood exports to the EU have increased to Can$5.4 billion in 2020, up by 47.7%.

Canadian beef exports to the EU in 2020 were 835 MT with a value of $14.25 million (up 82% in volume from 460 MT in 2019)

Canadian exports of environmental goods reached €1.6 billion in 2019, up 23.0% from €1.3 billion in 2016

Exports in 2019 of resource-based goods was 32.7%, an increase from 31.7% in 2018. Manufactured goods exports decreased to 67.3%, compared to 68.3% in 2018

For Canadian services exports to the EU, the three main categories were “other business services” (i.e., R&D, legal services, accounting, public relations, consultancy, professional services), transportation and travel services which together accounted for around 70.0% of the total in 2019.

EU accounted for 10.3% of 2020 defence export revenues for Canada’s defence industry

In 2020, Canada’s exports of ICT services were up $0.2 billion to $18.7 billion, representing 14.9% of total exports of services. One-fifth of these exports were to European Union countries, particularly France, Germany, United Kingdom, and Ireland

The EU is Canada’s second‑largest export market for cleantech products. Total trade in environmental goods amounted to €7.1 billion ($10.5 billion) in 2019, 17.2% higher than its level in 2016

Where to find EU contract notices

The EU’s various national governments, regional authorities, city councils, utilities and state-owned companies publish approximately 170,000 contract notices/tenders/bid opportunities every year. But with so many different agencies and organizations posting notices, how do you find the right opportunity?

The EU and EEA publish around 2,600 contract notices every day on Tenders Electronic Daily (TED). Information about every procurement document is published in the 24 official EU languages.

These are pulled in daily to Canada’s Global Bid Opportunity Finder (GBOF) and auto-translated into English and French for Canadians – regardless of the language they were posted in. Providing free access to EU procurement notices, GBOF lets you browse and filter procurement notices by industry, region and country, among other criteria.

Types of notices or solicitation used by the EU

The EU uses several different types of notices or solicitations, each with different processes and regulations:

Open procedures are the most commonly used notice, usually for low-value projects or those involving off-the shelf items. Criteria for bidding will be posted and any company that meets the criteria can bid. It’s a single-stage process, which means that after the bid, the winning company is chosen and the contract is awarded.

A restricted procedure is a two-stage process. Companies must be qualified to bid, submitting a proposal for evaluation before being invited to bid. The process may be accelerated or expedited, and there may be a restriction on the number of qualified companies invited to bid, even if many meet the criteria.

A competitive process with negotiation is the same as a restricted procedure, except that the contracting authority can negotiate with qualified bidders after the second stage of the bidding process.

Completing a bid for EU bids

Once you’ve found an opportunity (or been invited to bid on one), it is time to prepare a bid. Bidding often follows a double- or triple-envelope system, which requires technical, financial, and certification aspects of bids be submitted separately. This supports the independent assessment of each aspect of all bids. Failure to correctly separate bid aspects can lead to disqualification.

Note that the technical and financial aspects of the bid are usually what distinguish one bidder from another. To increase your chances of success, consider using a local specialist. You may also want to partner with a company that has won bids before or sub-contract to a company with more experience. That can help you get your foot in the door while also building your reputation among EU clients.

The technical bid is typically the longest and most time-consuming aspect of creating a bid. It should list specifications and details on the quantity or quality of the work.

Information included in the technical bid will vary by sector but the award criteria, contained in the tender documents or the contract notice, will guide bidders of the relative importance of various aspects. Use these to help you build your technical bid and maximize your chances of winning the business.

In most cases, the financial bids rank highly, and the bidder should include the overall costs for the contracts.

Remember that submitted bids are legally binding. If a bid is accepted, the bidding firm may be subject to legal penalties if it withdraws.

Writing the proposal for an EU bid

Conducting some intelligence gathering with the help of local experts and the Canadian Trade Commissioner will give you a better idea of what the buyer is looking for. Be aware of the laws and procurement regulations of the country you’re interested in, as these supersede any EU directives and regulations.

You should also be aware that while many contract notices are in English as well as the contracting authority’s national language, full sets of tender documents you will need to prepare your bid or proposal may only be published in the national language.

Many bids may also require paperwork to be submitted in the national language. Consider hiring a translator or partnering with a company that has local experience to help you meet these requirements.

Here are 6 things you’ll learn from our Guide to Building a Winning Proposal:

After you have determined the type of solicitation, how to assess whether you meet its requirement.

How to determine whether your offering is a right fit for the bid

Along with ensuring you meet the requirements of the solicitation document, you should make sure the money makes sense.

Once the solicitation is fully understood and evaluated in light of your company’s capabilities, the cost of doing business, and how it meets your long-term objectives, you’re almost ready to make your decision.

If you’ve determined that bidding on the opportunity is a “Go”, it’s time to plan how you will respond to it. A well-researched tender, followed by a planned response, can increase your chances of success—and minimize wasted time and money. We provide tips that can guide your process moving forward.

It is often said that there are two ways to compete: cost and differentiation. And with several other companies bidding on the same contracts as you, you will want to do everything you can to stand out from the crowd. We will review things you should consider to stand above the crowd.

Every year we help Canadian companies win millions in contracts with foreign governments. Download our guide to learn more about our approach, how we prepare you, and priority sectors.

Selection criteria for EU bids

Selection criteria determine which bidders may participate in the tender procedure. Contracting entities can exclude participants to restrict the selection process to the most qualified candidates and may relate to the following areas:

- suitability for the professional activity;

- economic and financial standing;

- technical and professional ability

Some procurement procedures require bidders to qualify via pre-selection. The criteria are usually strictly defined and even a minor omission at this stage may lead to disqualification. Bidders must typically request preselection documents from the contracting authority.

The contracting entity may also require that bidders register in a national professional body or trade registry. Most EU countries have registrars of companies which can be found in Annex XI of the 2014 Directive on Public Procurement.

The economic and financial standing are designed to confirm that the bidder has the financial and economic capacity to complete the contract. The contracting entity may require, that bidders have total annual revenues of up to twice the estimated value of the contract. In the cases of special risks associated with the contracts, the contracting authority may request a higher required turnover.

Bidders may be required to submit financial statements covering up to the last three years and proof of appropriate professional risk-indemnity insurance.

With regard to technical and professional ability, the contracting entity may require bidders to demonstrate adequate human and technical resources, and experience. This may include professional references or other evidence of skills, efficiency, experience and reliability.

Exclusion grounds for EU bids

A contracting entity is obliged to exclude companies if it has evidence that the bidder has been convicted of:

- participation in a criminal organization;

- corruption;

- fraud within the meaning of Article 1 of the Convention on the protection of the European Communities’ financial interests;

- terrorist offences, offences linked to terrorist activities, or inciting, aiding, abetting or attempting to commit an offence;

- money laundering or terrorist financing;

- child labour and other forms of human trafficking.

The contracting entity is also obliged to exclude bidders that breach the tax or social-security laws of the country where the contract is to take place.

Other reasons for exclusion include

- The bidder has violated national or EU environmental, social or labour laws, or the same laws as defined by the International Labour Organisation conventions, the Basel Convention, Stockholm Convention or the Vienna Convention;

- The company is in a state of bankruptcy or insolvency;

- The bidder has entered into agreements with competitors to distort competition;

- There is a conflict of interest that cannot be remedied by other means;

- There is prior involvement in government-procurement procedures has distorted competition and there is no other, less intrusive way to resolving the matter;

- Poor performance led to the termination of a contract, sanctions or claims for damages;

- Misleading information was provided to avoid exclusions

- The company has tried to unduly influence the decision-making procedure, has attempted to gain information that would give it an unfair advantage, or has provided misleading information that might influence decisions about exclusion, selection or contract award.

Role of Canadian Trade Commissioners

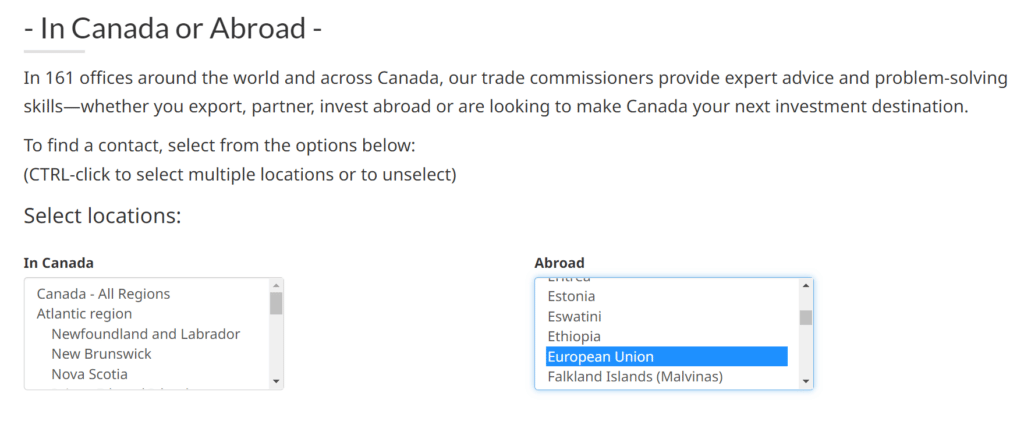

The Canadian Embassy in market is a trusted source of advice and guidance as you bid on projects and navigate the procurement process. You can Find a Trade Commissioner in your market of interest to get some guidance on the competitive landscape you are facing should you choose to bid or submit a proposal.

There are more than 1,000 trade commissioners located in more than 160 cities worldwide.

Trade commissioners provide expert advice to help companies learn how to take advantage of preferential access to these markets. They also deliver in-person and virtual information sessions, seminars, and trade missions to help companies understand opportunities in their market.

Your Trade Commissioner in market can also assist you to find contacts you can approach to partner with to submit proposals. As part of their core services, they will help you find qualified contacts and provide privileged access to foreign governments, business leaders and decision makers.

Role of unsolicited proposals

Careful use of unsolicited proposals can create demand for your product or service. Should your target customer be a government, you can explore using CCC’s International Prime Contractor program to assist your buyer to make the purchase from you on a government to government basis.

Use of the International Prime Contractor program also provides an indication to the contracting entity that your capabilities and proposal have been thoroughly vetted for ethical and responsible business practices.

How CCC can help

The EU represents a massive market opportunity for Canadian businesses — if you know where to look and how to tap the help available. CCC has decades of experience helping Canadian companies win contracts with governments around the world.

Contact us if you have a government buyer interested in making the purchase from you through the Government of Canada. For more information on how to access EU opportunities and prepare a winning bid, contact CCC today.

This post was last updated on July 27, 2022.

G2G contracting is a useful business tool to help connect businesses with foreign governments. Read some of the facts and misconceptions with Canada’s approach to G2G contracting.

Governments continue to invest in various infrastructure projects. In this blog, we provide a small sample of recent initiatives, trends and opportunities for Canadian companies in the transport and water infrastructure arena.

Let us help you explore ways that the Government of Canada can help you win more international deals.