Power Purchase Agreements – Tool for Canadian cleantech exporters

The risks associated with long-term power generation deals in developing markets can be significant obstacles for Canadian businesses. Learn more about power purchase agreements (PPAs) and how CCC can support these types of agreements with government buyers.

According to International Energy Agency’s June 2023 Renewable Energy Market Update, market-driven procurement of energy such as power purchase agreements (PPAs), is expected to account for one-fifth of utility solar photovoltaic and wind capacity expansion between 2023 and 2024, and almost twice as much (36 percent) when China is excluded. This represents a significant portion of the market and in this article we discuss more about this type of agreement, their expected use in various parts of the world and how CCC supports Canadian businesses with PPAs.

What are PPAs?

Power Purchase Agreements (PPAs) are contractual agreements between electricity generators and buyers. They are commonly used in the renewable energy industry, although they can also be employed in traditional energy sectors.

In a PPA (sometimes referred to as offtake agreements), the electricity generator agrees to sell a specified amount of electricity to the buyer (often a utility company or a large energy consumer) over a predetermined period, often 10 to 25 years. The buyer, in turn, commits to purchasing the agreed-upon electricity output at an agreed-upon price.

Here are a few variations on power purchase agreements.

Physical PPAs

In a physical PPA (sometimes called direct PPA or retail-sleeved PPA), the power is “physically” delivered by the (renewable) energy generator to the buyer through the grid. Since the buyer takes title to the energy produced, they must be on the same grid as the producer and the final price for delivered power is a function of the contracted PPA price plus transmission-related expenses.

In exchange for agreeing to offtake power for a fixed amount of time, corporate buyers of direct PPAs lock in energy rates for the renewable energy purchased over the contract term and earn the straightforward, compelling story of how their company runs on clean electricity. Energy market regulations and differences in markets across the country present drawbacks to this deal structure, though.

Virtual PPAs

Virtual power purchase agreements (VPPAs), sometimes referred to as a financial PPA, synthetic PPA or structured PPA, is a financially-settled arrangement between a renewable energy producer and a buyer where the buyer purchases renewable energy credits (RECs) from renewable projects to offset their carbon emissions. This can help buyers achieve their sustainability goals and support the growth of renewable energy projects.

Since the power generated by the developer is not directly used by the buyer, the producer and buyer do not need to be on the same grid. VPPAs can be appealing to organizations in markets that do not permit direct retail access to renewable power. It also can be very attractive for buyers that have multiple load centers.

Corporate PPAs

Corporate PPAs (CPPAs) are agreements where the offtaker is a corporate buyer. It provides a means for the corporation to increase visibility and certainty of future electricity costs, hedge against energy price volatility, mitigate risks against cost of carbon and meet sustainability goals. It also eliminates operation and maintenance (O&M) costs since the operational risk sits with the electricity developer and allow the corporation to focus on its core business areas.

Global PPA trends

United States

According to International Energy Agency’s IEA (2023), Renewable Energy Market Update – June 2023, over half of US utility-scale solar and wind growth is expected to come from bilateral contracts for either corporate or utility offtake, spurred by both economic attractiveness and corporate demand to meet sustainability goals. Corporate PPAs are forecast to account for the largest share (40 percent), mostly in the form of virtual PPAs in deregulated wholesale markets.

Consumer demand for virtual PPAs is expected to remain strong, in part because of the cost savings they can offer consumers by aggregating demand across multiple locations. For developers, the economics of PPAs are expected to remain appealing with the IRA extending the ITC, and with new opportunities for 10 percent premiums for projects being developed in energy communities starting in 2023. Additional revenue from renewable energy certificates (RECs) in some markets also strengthens the business case.

Europe

Looking at Europe, unsubsidised projects in the form of PPAs and merchant plants are expected to account for 22 percent of Europe’s capacity expansion. The majority of this will be corporate PPAs, led by Spain, Sweden, Germany, the Netherlands, and Denmark, with projects emerging in the United Kingdom, Italy, and Poland.

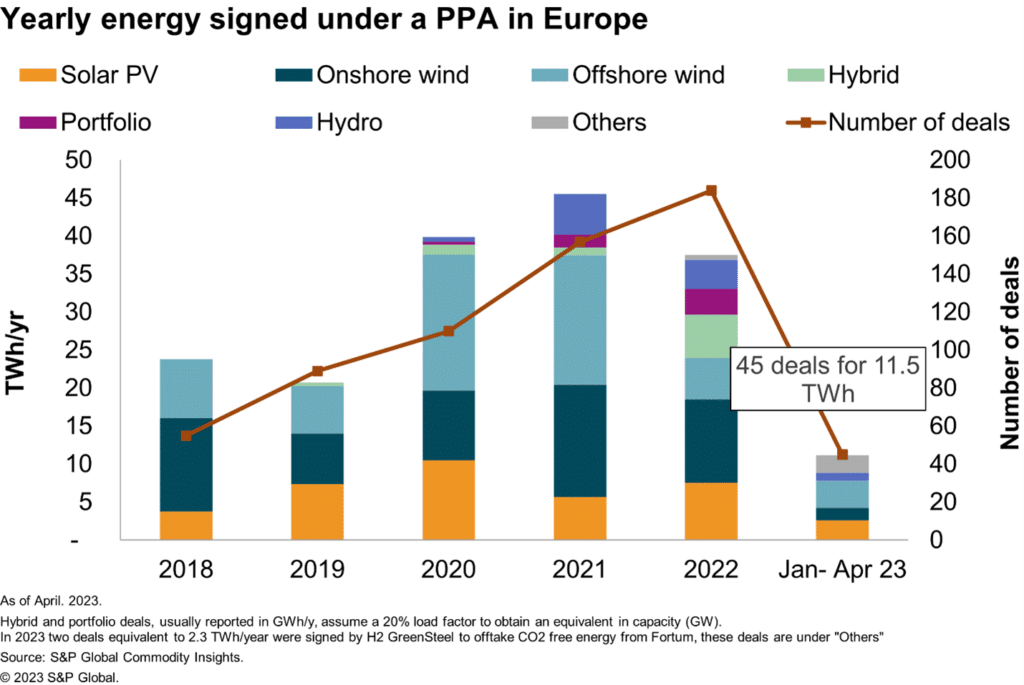

According to S&P Global Insights, over the past four years, the number of European PPA transactions has tripled, with over 180 deals signed in 2022 alone. Between January and April 2023, 45 PPA deals have been signed, setting the pace for further expansion of the PPA market. Spain accounted for most PPA transactions in 2022, as it did in 2021. Industrial companies, such as Alcoa, were the main offtakers for onshore wind, while companies such as Amazon, Equinix or IKEA signed major solar PV deals.

Source : S&P Global Commodity Insights.

Further growth is expected as the European Commission wants member states to facilitate PPAs. The proposal aims to address the major hurdle limiting the growth of the PPA market by introducing measures such as state guarantees to reduce and manage counterparty credit risk. This move is expected to encourage more investment in renewable energy projects and provide a stable market for the sale of renewable energy. Norway, Spain, and France have already put these measures in place.

European PPA Predictions for 2023

Pexapark, a provider of enterprise software and renewable energy advisory service, predicts the following for European PPAs in 2023:

- Short-term PPAs will become more popular. With price volatility above historic levels, the share of shorter-term, less costly PPAs versus long-term PPAs will dramatically rise.

- Project owners, utilities and corporates will leverage their individual strengths and competencies. In these tripartite deals, corporates take a fixed price profile and utilities provide the enabling trading and risk services to guarantee either fixed supplies or blends of 24/7 green supply.

- Increasing share of renewables-plus-storage projects. Volatility combined with system costs, will demand ‘smarter and more flexible’ renewables, that will leverage the benefits of colocation with energy storage assets.

Brazil

According to consultancy firm CELA (Clean Energy Latin America), the volume of energy contracted in Brazil from wind and solar projects at the free market dropped by 30 percent between March 2022 and March 2023. The drop is linked to the reduction of energy prices in the long run, the increase in interest rates and the elevation of capital for project implementation which ended up reducing long-term energy contracting in the free environment in Brazil. However, the market registered a greater number of contracts – 22 PPAs were signed in 2022 compared to 15 in 2021.

Asia

S&P Global Insights found that the growth of CPPAs announced in North America remained static in 2022 year-on-year, while other regions showed growth with Asia Pacific growing three times the volumes in the same period. About half of the companies announcing 100 percent renewable targets in 2022 came from the manufacturing sector, of which majority (80 percent) were headquartered in Asian markets including South Korea, Taiwan, and Japan.

The growth in Asia is driven by policy and market reforms in key markets to allow corporate renewable procurement. There is also growing corporate demand for renewables in industrial segments including manufacturing, materials, and services.

Global regulation reforms

There are many key regulatory reforms that are enabling corporate PPA growth across the globe including:

- Australia also passed a law to increase its national emission reduction targets

- Brazil is planning to introduce new market design that may result in material changes to the existing framework and more favorable conditions to corporate procurement

- India centralized open access application process which would reduce administrative challenges and delays

- Japan introduced a stimulus plan for decarbonization projects and a demonstration of non-fossil certificate trading by virtual PPA, and

- South Korea allows split sale electricity partially under a direct PPA and the remainder to the power market from the generation facility. Earlier, South Korea also reduced the threshold to participate in the corporate PPA markets.

Increased use of short-term PPAs

Short-term PPAs are expected to play an increasing role in the market. For example, German utility service provider Trianel expanded its offering of short-term power purchase agreements to include solar photovoltaic (PV) plants in 2022. The utility had already been offering such contracts, with terms in the range of three to six months for wind, biomass and hydropower plants since November 2021. For solar plants, the term of the PPAs could be extended to up to 12 months.

The City of Johannesburg’s City Power issued an RFP in late 2022 that invited independent power producers (IPPs) to supply the city with excess energy through a program of short-term power purchase agreements. The key objective of the program is to secure additional short-term energy for a period up to 36 months from IPPs to help shield the residents of Johannesburg from ongoing loadshedding.

To meet increasing demand, the Maharashtra Electricity Regulatory Commission (MERC) in India recently issued a detailed order giving approval for petition for tariff for short term power purchase agreements. Similar approvals have been signed by West Bengal Electricity Regulatory Commission, Kerala State Electricity Regulatory Commission and Tamil Nadu.

Download our guide to learn more about the massive global cleantech opportunity, and how Canadian companies can sell their products, solutions, and services to foreign governments through CCC.

U.S. DoD and PPAs

U.S. law allows the U.S. Secretaries of the Military Departments to enter into power purchase agreements for up to 30 years for energy production facilities on U.S. Department of Defense (DoD) real property. Like many government departments and agencies, the U.S. DoD has put an emphasis on carbon pollution-free electricity (CFE) and renewable energy procurements.

PPAs provide U.S. DoD installations with programmatic and acquisition assistance to meet the 2007 National Defense Authorization Act mandate to produce or procure not less than 25 percent facility energy consumed from renewable sources by 2025.

The intent of the U.S. DoD Power Purchase Agreement program is to purchase power and not acquire any power generation assets. It focuses on renewable alternative energy projects, but may include alternate energy sources that do not qualify as renewable but offer improvements or benefits in terms of greenhouse gas reductions, reduced energy costs or improved energy security.

The program is designed to develop and provide life cycle project management for large (>10 megawatt) and small (<10 megawatt) scale renewable energy projects (biomass, geothermal, solar and wind technologies) that leverage private sector finance.

It also provides a Multiple Award Task Order Contract (MATOC) vehicle for the long-term purchase (10-year ordering period) of energy from renewable alternative energy production facilities that private sector corporations design, finance, construct, operate and maintain on or near Department of Defense installations. The installation then purchases power from these facilities without acquiring any power generation assets, facilities, or services costs.

U.S. DoD links/resources

Companies looking to engage with the U.S. DoD on power purchase agreements can contact the following organizations.

How CCC supports PPA deals

Canadian companies or utilities with the experience and capacity to deliver renewable energy to foreign governments through PPAs can work with the CCC to facilitate projects and deals.

Canada’s government to government contracting approach allows CCC to be the prime contractor for any agreements with foreign government agencies or state-owned utilities. The Canadian business would the sign a sub-contract with CCC for services and act as the glue on energy projects, including bringing together all the suppliers, working with permitting authorities and the government buyer, managing construction, and obtaining financing.

With CCC in the mix, the Government of Canada guarantees the terms and conditions of the agreement and reduces the risks for the Canadian company leading the project.

Let’s talk PPAs

If you are working with a national, provincial, state or municipal government or a state-owned enterprise on a renewable project or PPA, come talk to us to see if Canada’s G2G contracting approach might be right for the project.

This post was last updated on August 14, 2023.

Learn how how to grow your sales by becoming a Cleantech exporter with CCC to sell your products and services abroad.

Learn how CCC supports Canadian cleantech businesses by supporting them in their pursuit of contracts with foreign governments

Let us help you explore ways that the Government of Canada can help you win more international deals.